A Mark Sadowski post

In this post we are going to add US inflation expectations as measured by the difference between the yield of 5-Year Treasury Constant Maturity Securities (GS5) and the yield of 5-Year Treasury Inflation-Indexed Constant Maturity Securities (FII5) to the baseline VAR which I developed in my last three posts.

This is often referred to as the 5-Year Breakeven Inflation Rate (T5YIEM).

The first thing I want to do is to demonstrate that the monetary base Granger causes inflation expectations during the period from December 2008 through May 2015. Here is a graph of the natural log of SBASENS and of T5YIEM measured in percent.

The following analysis is performed using a technique developed by Toda and Yamamoto (1995).

Using the Augmented Dickey-Fuller (ADF) and Kwiatkowski-Phillips-Schmidt-Shin (KPSS) tests I find that the order of integration is one for both series. I set up a two-equation VAR in the log level of SBASENS and T5YIEM in percent including an intercept for each equation.

Most information criteria suggest a maximum lag length of two. The LM test suggests that there is a no problem with serial correlation at this lag length. The AR roots table suggests that the VAR is dynamically stable at this lag length, and Johansen’s Trace Test and Maximum Eigenvalue Test both indicate that the two series are cointegrated at this lag length. This suggests that there must be Granger causality in at least one direction between the monetary base and inflation expectations.

Then I re-estimated the level VAR with one extra lag of each variable in each equation. But rather than declare the lag interval for the two endogenous variables to be from 1 to 3, I left the interval at 1 to 2 and declared the lag of each variable to be exogenous variables. Here are the Granger causality test results.

Thus I fail to reject the null hypothesis that inflation expectations does not Granger cause the monetary base, but I reject the null hypothesis that the monetary base does not Granger cause inflation expectations at the 1% significance level. In other words there is strong evidence that the monetary base Granger causes inflation expectations, but not the other way around.

Since the monetary base Granger causes inflation expectations it should probably be added to our baseline VAR model. This is because, under these circumstances, we might expect shocks to the monetary base in the VAR model to lead to statistically significant changes in inflation expectations.

With inflation expectations added to the baseline VAR model, most information criteria suggest a maximum lag length of two. However, an LM test suggests that there is problem with serial correlation at this lag length. Increasing the lag length to three eliminates this problem. An AR roots table shows the VAR to be dynamically stable.

The Johansen’s Trace Test and Maximum Eigenvalue Test both indicate that there exists one cointegrating equation at this lag length. But this is expected, since we now have evidence that the monetary base is not only cointegrated with industrial production, but also with inflation expectations. As discussed in the posts where the baseline VAR model was developed, since there is cointegration we should probably estimate a Vector Error Correction Model (a VECM), since it can generate statistically efficient estimates without losing long-run relationships among the variables as a VAR in levels (a VARL) might. However, in cases where there is no theory which can suggest the true cointegrating relationship or how it should be interpreted, it is probably better not to estimate a VECM.

I am using a recursive identification strategy (Choleskey decomposition), which is the dominant practice in the empirical literature on the transmission of monetary policy shocks. Such a strategy means that the order of the variables affects the results. For the three-variable VAR, I arranged the output level first, the price level second, and the monetary policy instrument third in the vector. This ordering assumes that the Federal Open Market Committee (FOMC) sees the current output level and price level when it sets the policy instrument, but that the output level and price level respond to a policy shock with one lag. For the four-variable VAR, the financial variable is ordered last, implying that financial markets respond to a policy shock with no lag. This ordering is essentially the same as Christiano et al. (1996), Edelberg and Marshall (1996), Evans and Marshall (1998), and Thorbecke (1997), which place the VAR variables in order of the goods and services markets first, the monetary policy instruments second, and the financial markets last.

As before, the response standard errors I will show are analytic, since Monte Carlo standard errors change each time an Impulse Response Function (IRF) is generated. Here are the responses to the monetary base and inflation expectations in the four-variable VAR.

The instantaneous response of inflation expectations to a positive shock to the monetary base is negative, but it is relatively small and statistically insignificant. This is followed by a statistically significant positive response in the third month. Furthermore a positive shock to inflation expectations in month one leads to a statistically significant positive response in the level of industrial production from months four through nine.

The IRFs show that a positive 2.6% shock to the monetary base in month one leads to a peak increase in inflation expectations of 0.048 percentage points in month three. In turn, a positive 0.10 percentage point shock to inflation expectations in month one leads to a peak increase in industrial production of 0.23% in month eight.

Why might an increase in inflation expectations lead to an increase in output?

Because debt payments are contractually fixed in nominal terms, an increase in inflation expectations should lower the expected value of liabilities in real terms. On the other hand, an increase in inflation expectations should not lower the expected value of assets in real terms. Monetary expansion that leads to an increase in inflation expectations therefore raises expected net worth, which lowers the perception of adverse selection and moral hazard problems, and leads to an increase in nominal spending and output. In fact, the view that increased inflation has an important effect on nominal spending has a long tradition in economics, and it is a key feature in the debt-deflation view of the Great Depression espoused by Irving Fisher.

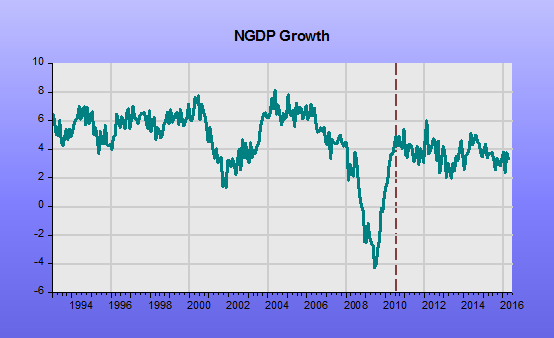

Perhaps of even greater importance, inflation expectations are the closest proxy we have for nominal GDP (NGDP) expectations, or expected aggregate demand (AD), as an increase in expected AD should also lead to an increase in inflation expectations, ceteris paribus. And an increase in NGDP expectations should lead to increased nominal spending by definition.

Too bad we didn’t have a prediction market for NGDP until December 2014. But I guess it’s better late than never.

Next time I shall add nominal Treasury yields to the baseline VAR.

Everybody knows that the whole purpose of QE is to drive down nominal Treasury yields, right?

Does it? Tune in next time and find out.