A James Alexander post

I had some hopes for fresh thinking due to the “outsider appointment” status of the Bank of England’s new’ish Deputy Governor for Monetary Policy Ben Broadbent. He wasn’t part of the clique around Mervyn King and the long-serving staffers like Paul Tucker the previous Deputy Governor who so messed up UK monetary policy in 2007-09.

His latest speech shows him falling into the very messy and confusing place, where central bankers love to be Kings of Discretion rather than Rule Abiding Good Citizens. He is so busy patting himself and his colleagues on the back for ignoring above target CPI in 2011-13 that he can’t see the damage he is causing and about to cause today.

We love teasing you, it makes us feel important

But he starts of by setting himself a pointless problem and then digs an enormous hole as an answer, partially digs himself out but then proves when you are in a hole you should stop digging.

The previous Governor of the Bank, Mervyn King, once referred to what he called the “rich seam” of MPC communication. Rich or not, it’s certainly a wide seam: MPC members each give several speeches a year; we publish minutes of every meeting, now supplemented with a Monetary Policy Summary; every quarter we publish a 50-page Inflation Report that summarises the MPC’s collective view of the economic outlook and includes our latest forecasts; every Report is followed by a session in front of parliament’s Treasury Committee. Yet, from all this, the outside world seems increasingly interested in only one particular nugget: the MPC’s central inflation forecast two years ahead.

The answer is simple: the Monetary Policy Committee sets monetary policy based on their forecast of inflation two years away. Inflation is always said by the Governor and his colleagues to be on target or off target by this “medium term” forecast. Of course, we all watch the forecast, that’s the world the BoE has created. The idiotic thing is that the forecast depends on the ever-so-slightly-circular market-implied BoE interest rate forecast, as created itself by nods and winks from the BoE.

The problem is that the “data” is very stubborn and near term inflation refuses to rise in line with the forecasts to allow the BoE to follow its desired rate normalisation path.

This is because their simple Philips Curve model of the world is wrong. Some would like to see the model and the results it produces, but for Market Monetarists it wouldn’t tell us much we don’t already know about their “slack theory” of inflation.

Slack being taken up does not lead to wage pressure and so does not lead to price pressure. Aggregate Demand, or rather aggregate nominal spending, drives prices up and that pulls wages up. And aggregate nominal spending is set by NGDP growth expectations. For all Broadbent’s protestations of the BoE having a flexible inflation target, the market is a better prophet.

The market can see the BoE’s obsession with the mid-point of its two-year out inflation forecast. But there really is no need to actually raise rates if the BoE is on target with its target as we said a few weeks ago. The market will anticipate the rises in rates and cool-off its expectations accordingly. This cooling-off acts as a break on nominal spending growth, in turn causing inflation to never rise as expected by the BoE. We are thus stuck in a self-defeating loop.

“Long and variable lags” the standard cop out of today’s bankrupt monetary economists.

Broadbent sets up three scenarios in the face of a “cost shock” sending inflation up by 2% to 4%. The second question he asks is how to get it down. Quickly. Slowly. Or, weirdly, “Drunkenly”? Actually, methods don’t matter, the fact that it must be brought down is all important. It’s not a flexible target, it’s still a 2% target. It is merely a flexible amount of time to bring it back to 2%. And it is gradually squeezing the life out of the recovery. It’s not too late to react, and the BoE probably will, just in time, but their reaction time is too slow.

Shouldn’t the policy horizon simply be the shortest time delay between changes in interest rates and their impact on consumer prices? Well one problem is that one can’t be entirely sure about what that delay is. As a famous economist once said, monetary policy seems to operate with “long and variable” lags.

It is funny how Milton Friedman is wheeled out repeatedly for this hoary old chestnut. He was really on to scare politicians and policymakers out of trying to fine-tune the economy. Friedman was probably just wrong on this point, as rational expectations theory has shown and the markets demonstrate day in day out by reacting immediately to unexpected changes in monetary policy, and to unexpected inaction in monetary policy to changes in the economic outlook. It is hard to see why it has gained status as a near religious truth.

Interestingly, when Milton Friedman said lots of other things he gets ignored or ridiculed, especially by Keynesians when it comes to his supply-side views on economics. More importantly, he also said that often you can’t tell the stance of monetary policy by the level of interest rates. He also ridiculed the idea of cost-push inflation.

Didn’t they do well?

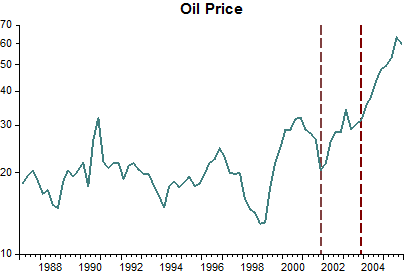

I think this had real relevance at the time I joined the MPC, in mid-2011. At that time … After a tepid recovery there was still plenty of spare capacity in the economy. Companies said they were operating well below capacity; unemployment was still high. But thanks to a series of cost shocks, including the big depreciation of sterling’s exchange rate 2-3 years earlier, inflation was nonetheless well above target.

In response, the MPC … took a more balanced approach. As I tried to explain in a speech I gave later that year, the MPC had arguably tolerated the (then) high rate of inflation for longer than it might have done because the real side of the economy was so weak.

It signalled this choice more explicitly in early 2013. Following a further depreciation in the currency, rises in administered prices and the prospect of continued weak growth in productivity, inflation was thought “likely to remain above target for much of the forecast period”. But “attempting to bring inflation back to target sooner…would risk derailing the recovery” and it was therefore “judged appropriate to look through the temporary, albeit protracted, period of above-target inflation”.

Was it so difficult in 2011 to look through headline CPI? Look at core inflation back then.

And the more appropriate measure to steer the economy, the GDP Deflator, was running at or below 2%. Of course, RGDP was certainly weak and falling. And the combination of the two, NGDP, was also weak and falling. In 2013, there was some modest recovery but we know how the BoE is currently squashing that with all its contractionary talk of rate rises sooner rather than later.

Quoting Svensson only when it suits, but are they symmetrical?

I don’t think this was so exceptional. There is no inflation-targeting monetary authority that behaves so rigidly as to attempt to offset all shorter-term shocks to inflation, no matter the effects on the variability of interest rates and output. As the economist Lars Svensson puts it, “in practice, inflation targeting is always ‘flexible’, because all inflation-targeting central banks not only aim at stabilizing inflation but also put some weight on stabilizing the real economy”.

While it is great to see the magpie Broadbent quoting Svensson what would Svensson be saying right now about the UK? Is he saying that now the UK is near “full capacity” and there is no need to get inflation back to target? I don’t think so. I think he’d be warning of the dangers of Japanese-style deflation, not fussing about when the next rate rise would be like Carney, or teasing the market, Broadbent-style, about the way to read or not to read the BoE’s intentions.

Broadbent indicates that the BoE is not targeting inflation but real variables

What is the BoE really up to? Well, actually, it appears to be trying to steer the real economy, and I’m not sure that’s their job or that it is possible. In three charts from his speech Broadbent shows the correlation between economic variables and average votes on the MPC to change rates.

The strongest, in fact the only meaningful, correlation is with real economic variables (Chart 3). But the real economy is a residual between nominal growth and inflation. And that is not a central bank job as all textbooks and mission statements will tell you.

They are not trying to steer inflation (Chart 2). This is good, because that is very tricky trying to steer the residual between real and nominal growth, even though it is what they should be doing according to their mission statement. So, sort of bad, too.

They are also not steering a form of NGDP (Chart 4, I think). This is bad as that is what they can actually steer, aggregate UK demand or nominal spending. And by not looking at NDGP they make big mistakes, causing instability in RGDP. They missed the rapidly declining NGDP in 2Q08 and appeared unconcerned by 3Q08, half-heartedly focusing, instead, on the banking crisis they had caused. Then, they are shamefully guilty of the four successive quarters of negative NGDP from 4q08 onwards with its appalling impact on RGDP, unemployment and lost growth.

They need to pay attention now as NGDP shows a bad trend in the UK, declining to 3.4% in 2Q15 and looking lower again in 3Q15. Broadbent needs to wake up and stop this somewhat smart-alec self-congratulatory lecturing.