A guest post by Benjamin Cole

One might think that QE3—the U.S. Federal Reserve’s program of buying bonds with money it creates—has been an unmitigated disaster, judging from the relentless ranting from America’s right- and left-wing economists, pundits and bloggers.

In a nutshell: The righties hate monetary stimulus, and insist the Fed bring us to zero inflation, and the lefties think a bigger federal deficit is what we need.

But in fact, since September 2012—when the Fed went to open-end, results-dependent QE—has the US economy done so poorly?

Not so poorly.

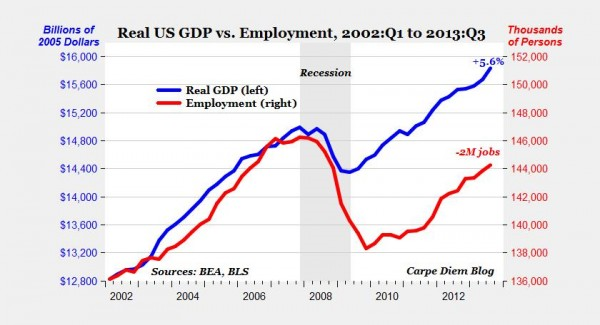

The facts: Since QE3, the private-sector has created about 2.70 million jobs, or about 192,857 jobs each month. The 2013 third-quarter GDP figure was recently revised to 4.1 percent real growth, albeit with some caveats. Since QE3, the S&P 500 has gained more than 25 percent, auto sales are very strong, and median house prices are up by double-digits.

That open-ended QE3 is working is evidently driving lefties and righties nuts. More on that later.

Not Market Monetarism…But Close Enough?

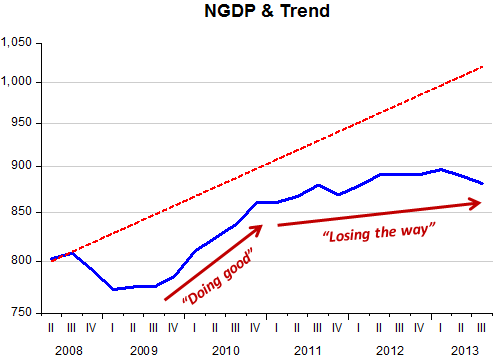

To be sure, QE 3 is not yet Market Monetarism, in which a rules-based Fed would target a nominal GDP, with clear and transparent guidance as the norm.

Still, the current QE 3 program is somewhat results- or rules-dependent, in that the Fed somewhat said they would stick with QE until unemployment reached a low enough level, or inflation got too high. Unemployment is hardly the best target, but it is a rough proxy for NGDP growth. And inflation is, of course, a component of NGDP. There has been forward guidance, if too-often undercut by wayward FOMC members rhapsodizing about inflation.

As I have written before, one Fed chair may target inflation and employment, and the next NGDP growth, but if they both agree on $85 billion a month in QE, then they have the same policy regardless of complicated arguments undergirding their stances. There is some indication that Alan Greenspan, Fed chair from 1987 to 2006, was in essence targeting NGDP growth, consciously or otherwise. Despite recent bashing, his record in the Fed is one of very sustained good growth and low inflation—things went south after he left, remember?

Economists Turn to Voodoo

Unhappy with the relative success of QE3—and I think QE3 should be larger not smaller—America’s left- and right-wing economists have become increasing strained, exotic and strident in their denunciations of the Fed program.

After first declaring QE would axiomatically spell hyperinflation, we have otherwise serious right-wing economists proffering theories that QE is…deflationary.

“What if we have the sign wrong?” asks John Cochrane, University of Chicago star. Lower interest rates mean lower inflation rates, posit Cochrane and others. Not quite voodoo economics, but getting there. One suspects the cart is before the horse, no?

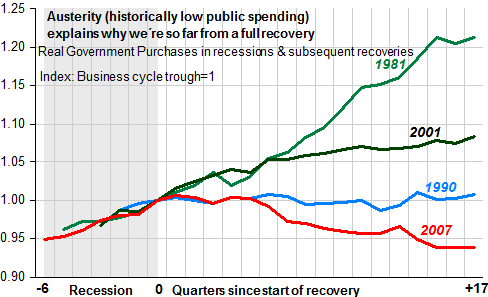

Top leftie Paul Krugman, for his part, insists that fiscal austerity is not working, and that we are in a vast liquidity quicksand—this despite the nearly 3 million jobs created since QE3, and a stock market up 25 percent. Such liquidity traps we can live with.

The Sad Part

The most lamentable aspect of the current economic “debate” is how rare are the economists pondering whether QE 3 should be more aggressive, or larger.

QE3 seems to be working, and inflation has sunk below one percent. Why not go larger? Or at least talk about it? (Scott Sumner, with his plan for a QE program that ramps up until targets are hit, is an exception.)

But economics has become a profession governed by social norms, scrims of indecipherable but fragile calculus and models, academic spitwad-fights and political agendas.

A peevish fixation on inflation governs the Fed and the mass of monetary thinkers (usually Fed-influenced), and the fiscalists think monetary policy is impotent.

Economics has become a profession in dire need of a shake-up, new blood, and intellectual diversity. QE3 looks like it is working, and without inflation. Maybe economists should try to explain that one.