A Benjamin Cole post

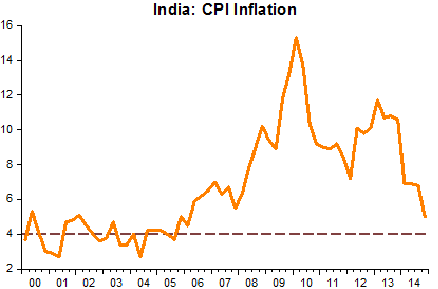

House prices feed heavily into U.S. inflation rates as measured, and as pointed out by Kevin Erdmann of the excellent blog Idiosyncratic Whisk, there is hardly inflation at all but for housing costs.

The matters little for U.S. Federal Reserve officials or the gaggle of inflationistas who monomaniacally jibber-jabber about prices. At every juncture, monetary policy is about the perils of inflation and the need to raise rates.

But, as noted by many, from here the Fed cannot tighten its way to higher long-term interest rates. The United States is in that monetary zone long ago noted by Milton Friedman: Interest rates are low as a consequence of tight money.

The present-day reality is this: Easy money for years on end does not lead to sub-2% 10-year US Treasuries, which we see in the market now.

And Fed policy gets more confounding. If the Fed raises rates, it will only succeed on the short-end of the curve. As money is already tight, long-term rates will sag, and that includes long-term mortgage rates.

Okay, so lower long-term mortgages rates, ceteris paribus, lead to higher house prices and thus higher rents, as rents are tried to house prices.

Of course, the real solution to high housing costs in the United States is twofold, involving aggressive upzoning or dezoning of property in high-cost cities, and a looser money policy and extension of credit to home-building industries and buyers.

An aggressive pro-growth monetary policy might actually result in prosperity and higher long-term rates. Oddly enough, the higher mortgage rates might somewhat depress house prices and related rents, which feed into reported inflation.

As it stands, there is little the Fed can do about property zoning, which is a local prerogative. At the last Fed shindig in Jackson Hole, every panel discussion was about inflation, but none mentioned property zoning. I would call this a blind-spot, but that would suggest the Fed has eyes.

In any event, the U.S. property-owning class in each city seems content to zone out competition, and is politically powerful. In the real world, prosperity in the United States will incur moderate inflation, in large part due to housing costs.

The Fed’s chosen solution is to prevent prosperity, but that is a central banker’s fix and not a good one. The Fed’s better recourse from here is to shoot for higher long-term growth and interest rates, and moderate inflation, by any means necessary, including helicopter drops.

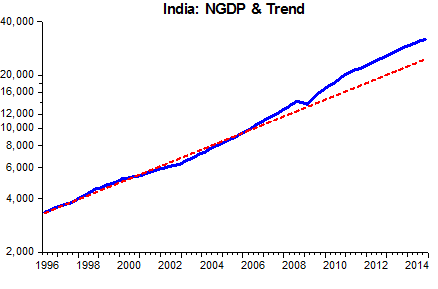

Of course, the best course is targeting NGDPLT.

The Fed is likely to enter the next recession with interest rates near the zero-bound and inflation dead. Then what?