A Benjamin Cole post

George Selgin, free banker, and one of the most intelligent and enjoyable luminaries in the entire econo-blogo-sphere, took issue with a December 20 post of mine, Zombie Economics Will Never Die.

Mostly, I am flattered Selgin even read my post, which reviewed a former Federal Reserve employee Daniel Thornton’s piece for Cato Institute entitled, Requiem For QE.

As a preface, let me confess I am a fan of QE, and think the Federal Reserve’s failing was that it employed QE timidly; not open-ended until QE3; never vowed that the Fed balance-sheet increase would be permanent; and, yes, QE was somewhat compromised by interest on excess reserves, as suggested by Selgin and Thornton.

But without further adieu, here is Selgin’s comment about my Thornton post:

“Benjamin, this is not a fair post, for all kinds of reasons, but mainly because many of the criticisms you offer are quite unrelated to the claims actually made in Thornton’s paper.

For example, when Thornton claims that QE may have resulted in some unsustainable asset price developments, you observe that there were booms and busts before QE–as if Thornton’s statement amounted to a denial of that fact!

When addressing Thornton claims that QE has unduly influenced the behavior of commodity prices, you criticize, not what he actually says, but what you “think he wants to say.”

You assume that the fact that corporate profits have been “soaring” somehow contradicts Thornton’s concerns about equity prices being excessively high. (Certainly it is now evident that such profits are no guarantee against a major correction.)

You treat the fact that housing starts are still below their level during the last boom as clear proof that Thornton is crazy to imagine that QE has provided excessive stimulus to the housing industry–as if forgetting about all the overbuilding that the last boom entailed.

But most of all, you are too intent on attacking “right wing inflation hawks,” and so, instead of addressing Thornton’s actual arguments about the origins and consequences of QE, you make him stand-in for your favorite bête noire, and then criticize the bête noire.”

Okay, let’s try to answer Selgin.

- Asset prices. After QE, the U.S. stock market recovered, eventually getting back to historic norms of 20 times earnings, and then flattening in the last year or so. This is during a time of undisputed all-time-record-smashing corporate profits, both relatively and absolutely. It’s been yuge. As an EMH fan, I tend to think the “market is right.” Is 20-times earnings “unsustainable,” as Thornton suggests? Seems in the ballpark to me. Did QE cause stock p-e’s to move back to historic norms? Or did the huge profits, and a seven-year (painfully slow) recovery? What would EMH say?

- Commodity prices. Thornton’s actual statement is that QE “caused a marked change in the behavior of commodity prices.” Oh, Heavens to Mergatroy, what does this even mean? Commodities have, in general, been declining since QE, especially since QE 3. Printing money causes commodities prices to dump? Gee whiz!

Actually, commodity prices are set on global stages, and are influenced by China demand, shale-inspired oil gluts, the U.S. ethanol program, new technologies and who knows what all. History shows commodities booming long before QE. Thornton’s opaque thundering is like so many other foggy dire predictions on QE, along the lines of “Yes, the other shoe will drop—just you wait.” If Thornton has a specific observation about global commodities prices and Federal Reserve QE, let him state it clearly. And again, I defer to EMH: I think commodity prices are what they are, due to global market forces.

- Housing and Overbuilding. Okay, real estate and housing prices have somewhat recovered to 2008 levels, along with the general economy. If QE helped, then I say good for QE. But I would implore George Selgin to read Kevin Erdmann’s blog, Idiosyncratic Whisk, for a while. In general, due to ubiquitous and highly restrictive property local zoning laws in the U.S., the supply of housing is crimped, especially where people want to live (NYC, SF, L.A., Silicon Valley, etc.). Naturally enough, the pervasive artificial constraints propel house prices north (and then feeds into the CPI, PCE). I go further than Erdmann, and ask, “Where is the single-family detached neighborhood anywhere in the U.S. that embraces high-rise condos, ground-floor retail and push-cart vending?” And again, I defer to EMH. Real estate developers built housing as consumers and apartment house owners were buying housing. The Fed caused a deep recession, fighting phantom-bogeyman So housing (leveraged, btw) did not sell. The nation never went through a period of national residential overbuilding, and indeed remains undersupplied in various markets, due to popular structural impediments (property zoning).

Well, enough of this. The genesis and understanding inside the Fed regarding QE may be tortured, and uncertain (well, it is the Fed). And I grant to Thornton, and Selgin that IOER is mysterious, and may reflect a type of industry capture of a regulatory agency (the Fed, in this case), or the Fed’s hysterical squeamishness about inflation.

To me, QE is money-printing and the monetization of national debt, and I am unabashedly for it. I would like to see QE married to FICA tax-cut holiday, with the QE-purchased bonds placed into the Social Security and Medicare trust funds. Whenever the economy slowed, this would trigger a FICA tax holiday and money-printing.

In conclusion, I say, “Print more money and build more housing!”

PS The question is sometimes raised if QE worked at all to stimulate the real economy, and I think it did. Of course, if QE raised asset prices, that had some positive effect, perhaps most in property, in which rising values lead to employment-generating restorations and sales work. There is probably another mechanism that I have never seen alluded to: Most individual and small businesses can only borrow against collateral, and that universally means real estate. (As a small business operator myself in years past, I knew this, and borrowed against my warehouse). Ergo, rising real-estate values increase the borrowing capacity of small businesses. If QE boosts real estate (as Thornton says) then it boosts the borrowing capacity of job-generating small businesses, too.

Another one of the outstanding oddities of modern economics is that no one seems to know who sold bonds into the Fed’s QE program, and what they did with the money they received. That was $4.5 trillion of newly digitized cash that bond-sellers received, and we know only that the bond-sellers thereafter—

- Bought other assets

- Spent the money

- Converted the digitized money to cash

- Put the money into commercial bank accounts

Of these four categories, only #4 would be inert (yes, banks were sitting on deposits), the other three actions would be stimulative. Conversion to cash may be inert if hiding under mattresses, but likely that money is circulating. BTW, cash in circulation is perhaps not trivial; there is $1.41 trillion circulating today, up from $820 billion in 2008. As long as inflation is dead, expect cash in circulation to expand rapidly, becoming increasingly useful for savings and tax-free transactions. The end-result of this no-inflation-induced burgeoning cash and underground economy is not pretty: Think of a Grecian Banana Republic. Only suckers pay taxes.

PPS It is a canard to define QE as “as swap of bonds for reserves.” The creation of reserves happens after the bondholders who sell into QE who in effect receive freshly digitized cash.

The bondholders sell to the 22 primary dealers, and it is the primary dealers who sell to the Fed, and then receive payment from the Fed into their commercial bank accounts. Those Fed payments are counted as reserves.

So, to be clear, bond-sellers received $4.5 trillion through QE and primary dealers also received $4.5 trillion. We do not know what the bond-sellers did with their fresh cash.

And to George Selgin, I say—can we just have a beer and watch the Super Bowl instead?

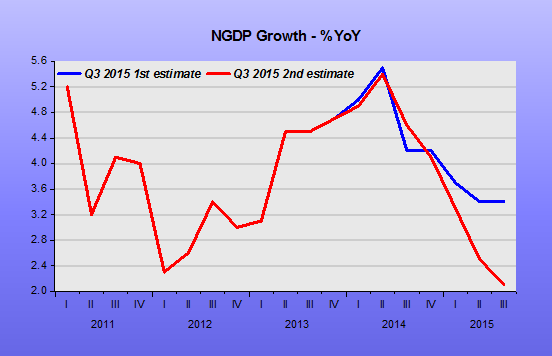

Sorry, one last PS: If the Fed is so easy, why is the US dollar stronger now against a trade-weighted basket of currencies than before 2008? And note that the dollar appreciation since mid-2014 goes hand in hand with falling NGDP growth, a sure sign of monetary policy tightening.