Simon Wren-Lewis characterizes the “adrift”:

The third interpretation about why central banks are doing nothing is there is nothing they can do. Quantitative Easing seems to have come to a permanent halt either because it has stopped having a useful effect, or because policy makers fear it is having undesirable consequences. Under this interpretation the inflation target loses credibility not because the private sector no longer believes policy makers’ stated objectives, but because they no longer believe they have the means to achieve them.

This possibility is the one that should really be worrying central banks right now. It is a scenario that is quite consistent with what is currently happening, and it puts at risk central bank credibility in a most fundamental way. Quite simply, central bank credibility is destroyed because people believe they have lost the ability (rather than the will) to do their job, and there is very little central banks can do to get it back because of the ZLB. This is what should be giving central banks nightmares. Strangely, however, they seem to be sleeping just fine.

To “compensate” they put on an “attitude”. To show they´re “active” the Fed has elected employment/unemployment as the “informant” on the “appropriate monetary policy” (or interest rate juggling). Note that, as late as 2009, with unemployment climbing fast towards 10% and inflation – both headline and core – dropping like a stone, they mostly talked about inflation during the FOMC Meetings. Now that they are “adrift”, they scramble to get “support” from the labor market!

Interestingly, 40 years ago Franco Modigliani with Lucas Papademos invented NAIRU (initially NIRU) – Non Accelerating Inflation Rate of Unemployment (Non Inflationary Rate of Unemployment) to argue from the “opposite extreme”. In their case, unemployment was far above NAIRU, therefore monetary policy could be expansionary without igniting an increase in inflation:

On the basis of these and other considerations, we conclude that a conservative interim unemployment target for mid-1977 is 6 percent. Achieving this target will require a growth of output of at least 17 percent over the next two years. Of this total, more than half should be achieved in the first year, to allow the growth rate to abate as the ultimate target is approached. Taking into account the price implications of this growth path, we conclude that in the first year money income should grow at an annual rate above 15 percent. From this it is argued that even if the primary stimulus to recovery comes from fiscal policy, as seems necessary to ensure an early and vigorous revival, the money supply will have to increase for a while at a rate well above 10 percent. There is wide concern that such a sharp acceleration in the money supply would have an unfavorable effect on the rate of inflation. But we allay this concern by showing that the evidence is clearly inconsistent with any influence of money on inflation outside of its indirect effect through its contribution to the determination of aggregate demand and employment.

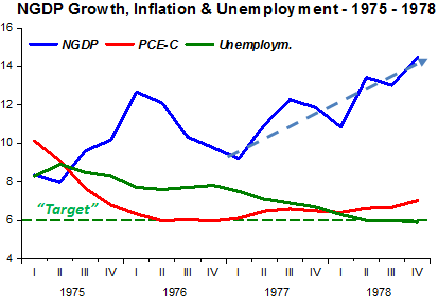

How did things pan out? The chart below indicates that unemployment, which was above 8% when Modigliani & Papademos wrote, came down slowly, as did inflation. However, when NGDP growth accelerates, unemployment falls faster towards the 6% “target” but inflation begins to rise long before the “target” is reached.

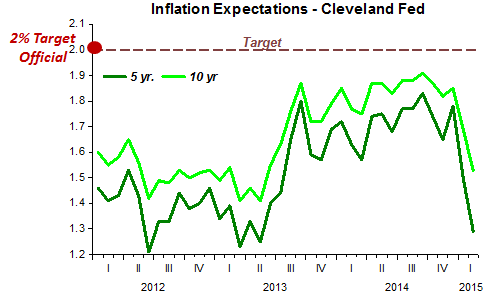

In early 2012, when the Fed introduced the 2% inflation target, unemployment was, as in 1975, above 8%. Given that inflation was sliding below the 2% target the Fed “stipulated” that 6% unemployment would indicate the time was ripe for rates to begin to rise! What´s this fixation on 6% unemployment (understood to be the NAIRU level)?

Nevertheless, with unemployment falling towards “target” but with inflation continuing to drop, the Fed “reestimated” NAIRU at something between 5% and 5.5%. As of today, we are at the top of the “NAIRU band”, but inflation is still moving slowly down! Note, importantly, that differently from the 1970s, NGDP growth has remained stable (shy of 4%), a rate of spending growth that is consistent with higher than target inflation only if trend (potential) real output growth is below 2%. By insisting on keeping the economy at a “depressed” level of activity, low trend growth may in fact become “reality” (or the “new normal”). The Fed will then feel vindicated in raising rates, while the “New Fisherians” will feel vindicated in seeing higher rates hand in hand with higher inflation!

In the 1970s, “targets” for unemployment got us into inflationary troubles. Now, “targets” for unemployment will get us into “stagnation” troubles. My good friend Benjamin Cole clearly prefers the former!

Update: Krugman has something useful to say on the NAIRU “controversy”:

I very much hope that Fed staff remembers the 1990s. Circa 1994 it was widely believed, based on seemingly solid research, that the NAIRU was around 6 percent; but Greenspan and company decided to wait for actual evidence of rising inflation, and the result was a long run of job growth that brought unemployment below 4 percent without any kind of inflationary explosion. Suppose they had targeted the presumed NAIRU instead; they would have sacrificed trillions in foregone output, plus all the good things that come from a tight labor market.

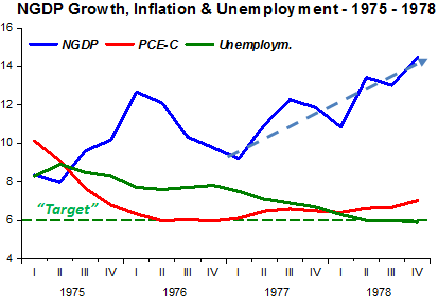

The chart illustrates:

Here,also, NGDP growth is stable (not at the 4% range but at the 5.5% range). Inflation remains low and even falls (productivity shock) and the 6% NAIRU estimate was completely irrelevant!