In “Years of Fed Missteps Fueled Disillusion with the Economy and Washington”, Jon Hilsenrath gives his contribution to the “Great Unraveling” series. He starts off writing:

In the past decade Federal Reserve officials have been flummoxed by a housing bubble that cratered the financial system, a long stretch of slow growth they failed to foresee and inflation persistently undershooting their goal. In response they engineered unpopular financial rescues, launched start-and-stop bond buying and delayed planned interest-rate boosts.

“There are a lot of things that we thought we knew that haven’t turned out quite as we expected,” said Eric Rosengren, president of the Federal Reserve Bank of Boston. “The economy and financial markets are not as stable as we previously assumed.”

In the 1990s, a period known in economics as the “Great Moderation,” it seemed the Fed could do no wrong. Policy makers and voters saw it as a machine, with buttons officials could push to heat or cool the economy as needed. Now, after more than a decade of economic disappointment, the central bank confronts hardened public skepticism and growing self-doubt about its own understanding of how the U.S. economy works.

For anyone seeking to explain one of the most unpredictable political seasons in modern history, with the rise of Donald Trump and Bernie Sanders, a prime suspect is public dismay in institutions guiding the economy and government. The Fed in particular is a case study in how the conventional wisdom of the late 1990s on a wide range of economic issues, including trade, technology and central banking, has since slowly unraveled.

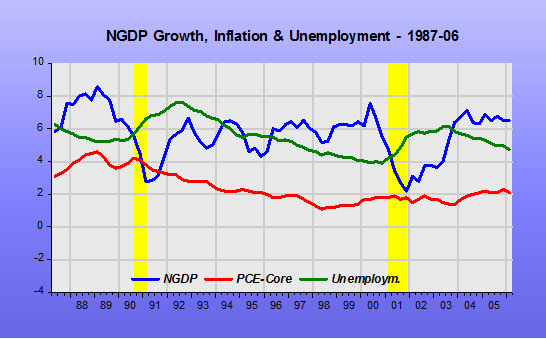

During the Great Moderation, the Fed did do wrong. It just didn´t fail utterly! I believe the chart tells a convincing story.

Note that during the Great Moderation – the Greenspan years – NGDP growth was relatively stable. In 1990-91, the story is the Fed engineered a “strategic Disinflation”, with inflation coming down from the 4% level to 2%. In 2000-02 the Fed, worried about the low (4%) rate of unemployment and what it would do to inflation, erred, allowing NGDP growth to fall significantly. This mistake was subsequently corrected.

In level terms we see that NGDP remained close to its “target level”.

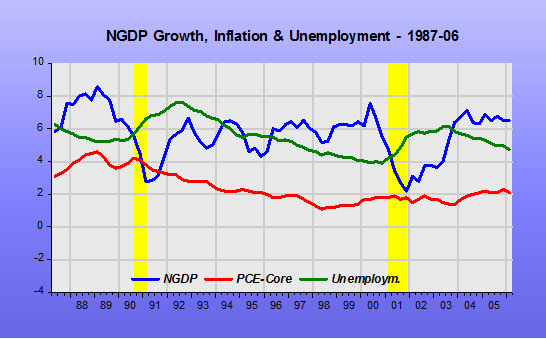

In the first two years of his mandate, Bernanke managed to keep NGDP close to its “target level”. Inflation remained very close to target and unemployment low and stable.

The follow-up in 2008-09, however, was a disaster. The Fed allowed NGDP growth to take a beating. The result was a massive increase in unemployment (given wage stickiness) with inflation dropping below target.

This outcome is very closely linked to the Fed´s renewed obsession with the likelihood of inflation shooting up on the heels of an oil shock. This is somewhat surprising given that 10 years earlier, in 1997, Bernanke and co-authors had published a paper “Systematic Monetary Policy and the Effects of Oil Price Shocks” (now gated), which was summarized by Business Insider in March 2011, at the time the ECB was considering hiking rates because of the oil price rise.

Earlier we mentioned a Ben Bernanke paper from 1997 titled, Systematic Monetary Policy and the Effects of Oil Price Shocks and while the full thing is definitely worth a read, we have a breakdown for you right here.

CNBC is talking about it today, too, in light of the ECB’s talk of higher rates.

The thesis is that it is central bank monetary policy in reaction to oil price spikes that creates economic downturns, not the oil price spike itself.

On the other hand, a rate hike ends up causing problems for years, reducing output.

The implication of this is that Federal Reserve Chair Ben Bernanke has no interest in raising rate for a commodity or oil spike, so long as prices remain within Fed range, because it has a damaging impact on output that could send unemployment higher.

In 2008, however, the Bernanke Fed was very worried about the inflationary impact of oil. Although the Fed didn´t raise rates (they didn’t lower them either between April and September 2008), all the FOMC talk, as gleaned from the 2008 Transcripts, was about the risk of inflation and how the next rate move would likely be up!

“Fed talk” is monetary policy, and it gets transmitted through the expectations channel. You get the idea about how monetary policy was severely tightened during 2008, in addition to looking at the behavior of NGDP growth, that tanked, by looking at how the dollar strengthened, how the stock market plunged, and how long-term interest rates dropped.

In mid-2009 the economy began to recover, with NGDP growth reversing course. QE1 had a positive impact.

During this policy easing, the dollar fell while stocks and long-term bond yields rose.

For some reason, by mid-2010 the Fed decided that “enough was enough”. QE1 ended and NGDP growth was stabilized initially at 4%. In other words, unlike after the 2000-03 when NGDP fell below trend but was brought back to trend, this time around the Fed decided that a lower trend path was the way to go.

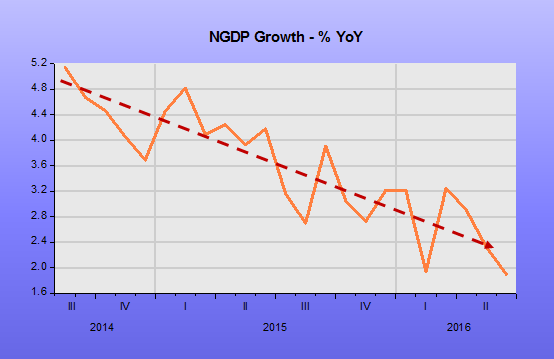

For the past two years, even with inflation remaining below target, through its raise hike talk the Fed has been tightening monetary policy. NGDP growth is coming down, the stock market has remained sideways while the dollar has boomed, oil prices have tanked and long-term bond yields are coming back down. It seems the Yellen Fed is guided by the unemployment rate.

It is, therefore, not surprising that the level chart for the Bernanke/Yellen period contrasts sharply with the one observed during the Greenspan years ( I would have imagined that would give useful pointers for the “design of a new monetary framework”)

The Jackson Hole Conference had an encouraging title: “Designing Resilient Monetary Policy Frameworks for the Future”. Unfortunately, they mostly talked about the nuts & bolts of policy implementation. Furthermore, while Yellen signalled one rate rise this year, her number 2 Stan Fischer said he “roots” for two. And Bullard said once in the next two years!

It was certainly a missed opportunity for the Fed to regain some modicum of credibility.