A Benjamin Cole post

The central bank strategy of buying bonds, usually government issue, is known as “quantitative easing.” As practiced, QE appears stimulative, while paying off bondholders with cash, and essentially eliminating national debt. Nowhere has QE—in Europe, Japan, or the United States—resulted in much inflation. But one must scour the Internet in search of a favorable word on behalf of QE.

Oddly Enough

If you burrow deeply enough, you can find a paper written in September 2006 by right-wing iconic scholar John Taylor, who gushed about the positive results of QE, then undertaken by the Bank of Japan to flog some life into their deflation-slow growth economy.

“In the last three years, the Japanese economy has improved greatly compared to the decade-long period of near zero economic growth and deflation that began in the early 1990s. Once again Japanese economic growth is contributing to world economic growth as the expansion in Japan begins to set records for its durability.

What has been responsible for this recovery? The key to the recovery, in my view, has been the quantitative easing of monetary policy….”

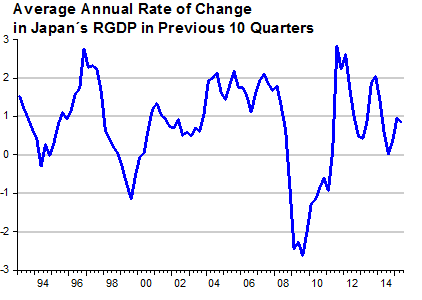

Unfortunately, the Bank of Japan backed away from QE, and Japan went right back to the economic freezer. Evidently, the topic of QE thereafter became politicized.

Last Time

Taylor’s soliloquy to the triumph of QE might be the last time any U.S. economist said something nice about central bank monetizing, or paying off, of national debt to stimulate growth. From what I can gather, it is not PC in right-wing circles to like QE, as it is damned as either inert or hyperinflationary or maybe immoral, or in left-wing circles, who want piles of social welfare spending instead.

Moreover, there is a tangle of competing explanations why QE may or may not work, with a favorite dismissal in right-wing circles (since QE did not result in hyperinflation) that “QE is just a swap of bonds for reserves.”

Of course, this dismissal ignores the fact the Treasury bond-owners who sold into QE received cash, and also bank reserves swelled by an amount equivalent to the amount of QE. That is because when the Fed buys bonds, it does so only from the 22 primary dealers. The 22 primary dealers get reserves equal to Fed bond purchases, placed into their commercial bank accounts.

Consumption

In academia there is little discussion that QE might stimulate consumption directly. That is, bond-sellers can place an immediate claim on goods and services, once they have sold their bonds. Before QE, a bond-seller would have to sell, say, a $100,000 Treasury bond to another private-sector buyer, and that buyer would have to give up $100,000 in cool cash. No new Jaguar in the garage for the bond-buyer. But, post-QE, the seller instead sells to the Fed, no one in the private sector gives up anything.

There is, post QE, $4 trillion in digital and paper cash out in the economy that can place immediate claim on goods, services or assets.

Of course, the Fed website talks obliquely about portfolio rebalancing, that is people who sell bonds move into other assets, pushing up prices. A rally in stock and property prices gets the economy going too. And interest rates (ceteris paribus) fall, and that is good too. But the direct consumption angle is not mentioned.

I also wonder about the positive effects of paying off the national debt with cash. This topic is evidently verboten, and never discussed. But debt reduction it is going on in Japan, and without inflationary impact.

For decades, U.S. doomsayers have screamed about mounting national debt, and grandchildren in debt bondage to Chinese or Japanese overlords, or Wall Street rentier-barons. I do not like mounting national debt, btw.

But the Fed can print up money, pay off the national debt, and spur the economy. Inflation does nothing, at least so far.

What is it that economists don’t like about QE?

PS Rodney Dangerfield? An American comedian, and very American at that. Sadly, since passed away. “I tell you, I get no respect, no respect at all,” was his signature line. I liked his joke, told in the crime-ridden 1980s, “I tell you I get no respect. I go down to the grocers, and some guy holds me up with knife. It still has peanut-butter on it. No respect at all.” And QE gets no respect.