Here:

Maintaining zero interest rates for so long is creating a scenario in which containing risks “becomes virtually impossible,” according to an analysis from a former Fed official.

A “muddled mandate” has the Fed too focused on unemployment at the expense of price stability, wrote Athanasios Orphanides, a global economics professor at the Massachusetts Institute of Technology’s Sloan School of Management.

Former Fed boards knew enough to begin raising rates after long periods of accommodation well before the economy hit the full, or “natural,” unemployment rate, said Orphanides, a respected former senior Fed advisor and member of both the European Central Bank and Central Bank of Cyprus. The paper outlining his views appeared on the St. Louis Fed website and is based on a June speech he gave to that branch of the U.S. central bank.

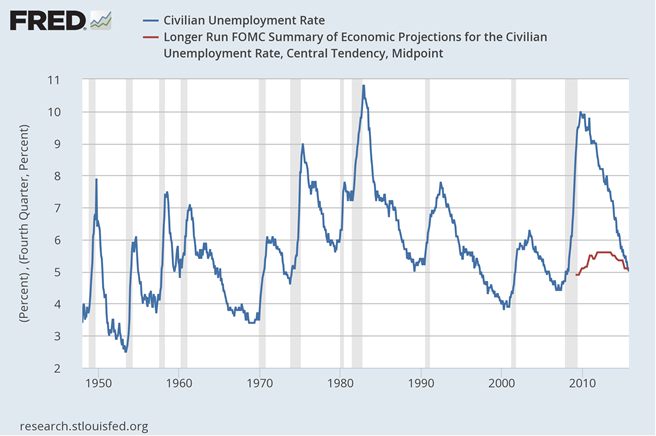

In the analysis, he paints a grim scenario should the Fed not choose to start hiking rates soon, calling the current scenario “the case of the missing liftoff.” The unemployment rate, currently at 5.1 percent, equals the 5.5 percent rate that the Congressional Budget Office considered full employment back in February, signaling the Federal Open Market Committee is well behind when previous Feds chose to begin raising rates, he said.

To get past the policy confusion, Orphanides recommends the approach that previous Feds followed, particularly after recessions in 1981, 1990 and 2001.

“The Federal Reserve followed this prudent, pre-emptive approach after every recession in recent decades. This strategy kept inflation in line with reasonable price stability and avoided stop-go cycles and abrupt and costly corrections. Not this time,” he said. “Six years after the end of the Great Recession, the Federal Reserve has yet to begin the process of normalization from the unprecedented monetary accommodation it engineered during and after the Great Recession.“

The problem is that they keep calling “unprecedented monetary accommodation” when, in reality, what we´ve seen is “unprecedented monetary stinginess”!

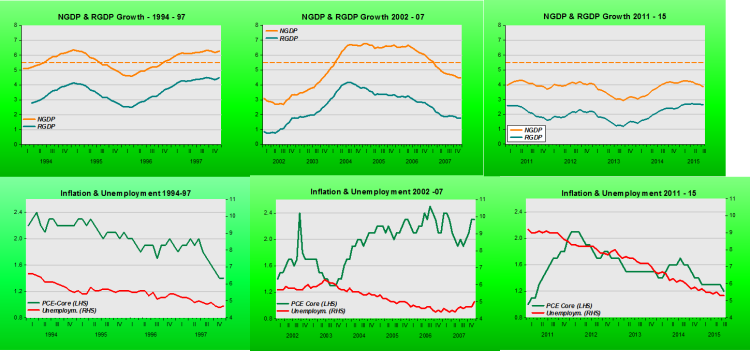

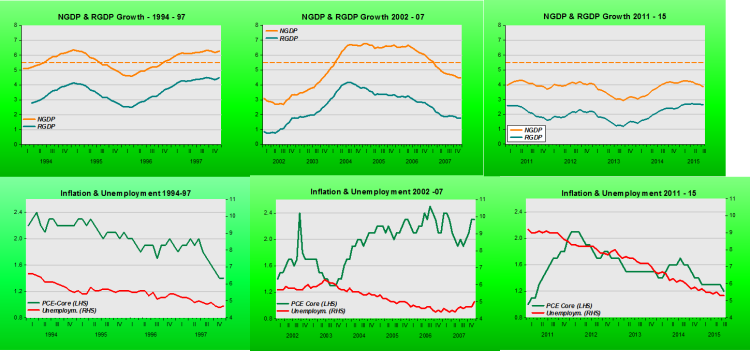

As Friedman said long ago and Bernanke repeated 12 years ago, interest rates do NOT indicate the stance of monetary policy, for that you have to look at things like NGDP growth and inflation!

The charts shows what reasonable (not great) monetary policy was after two of the periods Orphanides mentions. This time, with NGDP growth so “stably” low, there´s no chance of a sustained pick-up in inflation!

But as the first sentence above makes clear, Orphanides, like former Governor Jeremy Stein, is worried about “containing risks” and also like J Stein thinks interest rates “gets in all the cracks”!