In his post – Europe´s Second Depression – Krugman writes:

Aha — in my post on Europe’s policy failure, I somehow failed to notice that the new Maddison dataset provides per capita real GDP, which means that I should use per capita GDP in looking at the current crisis. And my point about dismal performance gets even stronger:

Europe in 2013 has recovered worse from its slump than Europe in 1935. Again, great work, guys.

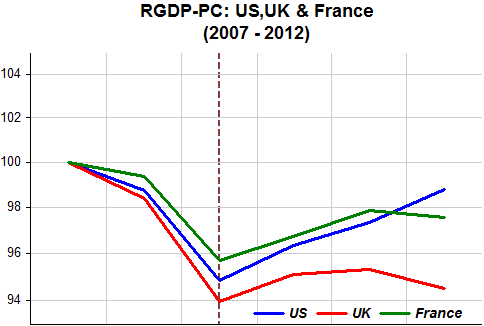

So I decided to make a per capita RGDP comparison among a small set of significant economies: US, UK, France & Germany both in the 1929-39 and 2007-12 periods. “These are their stories” (Note: within each period the scales are the same):

In the “Great Depression” the US tumbled much more than the others. Britain was the first to leave the gold standard (1931)(color-coded dashed bars) and recovered sooner. France only left the GS in 1936. The US in 1933 but had a recession within the depression in 1937-38 courtesy of the Fed and Treasury misguided policies.

What about Germany? Hitler comes to power in January 1933 and almost immediately begins the war build-up. It has the strongest recovery.

Flash-forward to 2007-12. This time around Britain does worse. After seeing real incomes fall more than in France, monetary freedom in the US allows a comeback and avoids a recession within the “Great Recession” that befalls the UK and France. But all in all, a pretty lame performance:

What about Germany, ‘leader of the euro zone pack’ where many countries are ‘under water’?

How can that be? While others are now ‘diving’, it has only registered a slowdown. This is additional evidence that policy, in particular monetary policy, has been effectively geared to German needs. And we know that Germany imposes its fiscal policy on the ‘others’.

So it´s a mystery why a ‘free country’ like Poland would wish to join!

Note that Poland has it´s own scale! One has to wonder if leaders over there have a “suicide-wish”!

Note that Poland has it´s own scale! One has to wonder if leaders over there have a “suicide-wish”!

Update: A good related piece from Matt O´Brien:

History doesn’t need to repeat, or even rhyme. Europe doesn’t have to keep crucifying itself on a cross of euros, the gold standard of the 21st-century. The euro’s northern bloc could decide to let the ECB do more. Or it could decide to start spending more. Or not. Eurocrats seem content to do just enough to keep everything from falling apart, and nothing more. It’s one part inflationphobia, and another part strategy. Indeed, it’s how they try to keep the pressure on the southern bloc to push through unpopular labor market reforms. But doing enough today eventually won’t be enough tomorrow if the southern bloc doesn’t have any hope of recovering within the euro. The politics will turn against the common currency long before that.

By that point, Europe won’t need an acronym anymore.