Minnesota Fed Neel Kaskari published today “Why I dissented”, to explain the reasons for his dissent in the latest FOMC Meeting. His dissent has a dovish slant, but does not differ materially from the consensus view. In short, the relationship between inflation & unemployment, known as the Phillips Curve, is still very much alive in the Fed´s decision-making process:

“I strongly support the new Statement on Longer-Run Goals and Monetary Policy Strategy¹ that the Federal Open Market Committee has adopted. It incorporates the lessons we have learned from the prior recovery and gives the Committee sufficient flexibility to make up for periods of low inflation in order to achieve our dual mandate goals.

However, I voted against the FOMC’s September 16, 2020, policy statement because, while I believe the statement is a positive step forward in putting those lessons into practice, I would have preferred the Committee make a stronger commitment to not raising rates until we were certain to have achieved our dual mandate objectives.

The 2015 tightening cycle

To explain my rationale for seeking stronger forward guidance, I first must review what I learned from the recent tightening cycle that began in 2015. That policy tightening was predicated on the Committee’s view that the labor market was reaching maximum employment and therefore inflation was around the corner.

When I first became an FOMC voter, I dissented against all three of the Committee’s rate hikes in 2017 because, as I wrote then: “We are still coming up short on our inflation target, and the job market continues to strengthen, suggesting that slack remains.” ²

Recently, Governor Brainard commented: “had the changes to monetary policy goals and strategy we made in the new [monetary policy strategy] been in place several years ago, it is likely that accommodation would have been withdrawn later, and the gains [to the labor market] would have been greater.” ³

We misread the labor market and, as a result, the tightening cycle that we embarked upon was not optimal to achieving our dual mandate goals of maximum employment and stable prices.”

…In recent years, we have repeatedly believed we were at or beyond maximum employment only to be surprised when many more Americans reentered the labor market or chose not to leave, increasing the productive capacity of the economy without causing high inflation. To me, maximum employment is the point at which the labor market is just tight enough to deliver 2 percent inflation in equilibrium.”

The highlighted segments indicate the close connection the Fed, even its more dovish members, see continue to exist between unemployment and inflation.

This is not surprising. In March of this year, Marco Del Negro, from the New York Fed, and coauthors presented a paper for discussion with reference to the New Statement on Longer-Run Goals titled “What´s up with the Phillips Curve”:

“Inflation has been largely disconnected from business cycle ups and downs over the past 30 years. This puzzling observation is one more reason why the Federal Reserve should consider adopting a systematic monetary policy strategy that reacts more forcefully to off-target inflation—whether too high or too low.”

In What’s Up with the Phillips Curve?, the authors note that inflation in the United States has remained remarkably stable since 1990, even in the face of pronounced cycles in economic activity. For example. the unemployment rate has fallen from a 25-year high of 10 percent in 2009 during the Great Recession to near 50-year lows of at or under 4 percent over the past two years. But U.S. inflation hasn’t responded much to the steep drop in joblessness and remains somewhat short of the Fed’s 2 percent inflation target.

They don´t think monetary policy has been the major factor:

Changes in the conduct of monetary policy appear to have played some role in inflation stability in recent decades, but they cannot be its principal explanation, the authors suggest.

Their leading candidate for the driver of inflation stability is a reduced sensitivity of inflation to cost pressures—such as those associated with wage movements—or, in economic parlance, a decline in the slope of the Phillips curve. This could be due to many structural forces—such as the increased relevance of global supply chains, heightened international competition, and other effects of globalization.

So, they recommend Average Inflation Targeting (AIT):

A flat Phillips Curve requires the monetary authority to work harder to stabilize inflation: Unemployment needs to get lower to bring inflation back to target after a recession,” the authors write. They use an econometric model to explore how monetary policy should adapt, examining, for example, a strategy known as average inflation targeting—one of several strategies the Federal Reserve has been evaluating during a public review of its monetary policy framework.

It´s a pity the Fed ignored much better advice, some from people advocating NGDP Level Targeting.

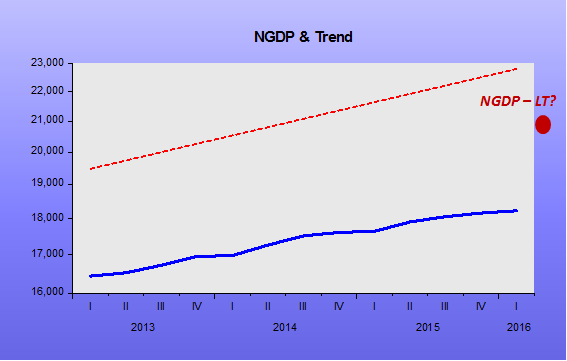

The panel below, covering the post Great Recession “Longest Expansion” provides interesting pointers.

- A stable NGDP growth is associated with falling unemployment (and stable inflation)

- When NGDP growth falls (below its average growth), unemployment stabilizes (stops falling) and when NGDP growth rises above its average growth, unemployment falls faster.

- The Fed´s juggling of the FF rate does not seem to connect to either inflation or unemployment (with unemployment falling “faster” during the period the FF was on the rise). That was more likely because NGDP was growing more.

FOMC members would do well to read and reflect on a recent paper by Alan Cole of the Senate´s Joint Economic Committee titled “A stable monetary policy to connect more americans to work”:

“The best anchor for monetary policy decisions is nominal income or nominal spending—the amount of money people receive or pay out, which more or less equal out economy-wide. Under an ideal monetary regime, spending should not be too scarce (characterized by low investment and employment), but nor should it be too plentiful (characterized by high and increasing inflation).

While this balance may be easier to imagine than to achieve, this report argues that stabilizing general expectations about the level of nominal income or nominal spending in the economy best allows the private sector to value individual goods and services in the context of that anchored expectation, and build long-term contracts with a reasonable degree of certainty. This target could also be understood as steady growth in the money supply, adjusted for the private sector’s ability to circulate that money supply faster or slower.

Bottom Line:

The Fed´s new strategy may just be a tweak on its old strategy in order to “accommodate” a belated realization that the Phillips Curve is (or has become) flat!