A Mark Sadowski post

Here’s Scott Sumner discussing the Japanese economy as an example of the Great Stagnation.

- In the 1st 4 quarters of Abenomics (i.e. 2013), RGDP grew by 2.4%, which we now know was a flat out boom. Inflation rose into positive territory and the unemployment rate fell from 4.3% to 3.7%.

- From the 4th quarter of 2013 to the 2nd quarter of 2015 the Japanese economy grew by a grand total of 0.1%. And the unemployment rate continued to fall, from 3.7% to 3.4%. That’s right, over the past 6 quarters the Japanese economy has been growing at above trend. But that blistering pace can’t go on forever. The unemployment rate is down to 3.4%, and unless I’m mistaken there is a theoretical “zero lower bound” on unemployment that is even more certain than interest rates. The Japanese economy is like a Galapagos tortoise that has just sprinted 20 meters, and needs a long rest.”

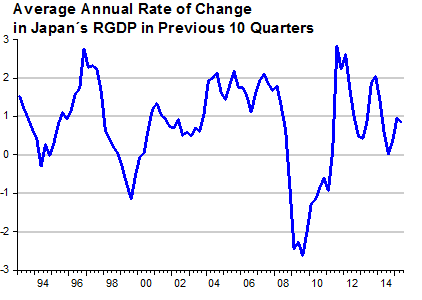

Let’s take a look at the ten quarter moving average of RGDP growth in Japan. All data comes from the Japanese Cabinet Office. (Pre-1994 data using 68SNA values has been chained to post-1994 data using 93SNA values.)

It’s true, RGDP growth has only averaged 0.86% in the last ten quarters, which is nothing remarkable, even when compared to the low bar set by the average performance of the Japanese economy since 1993. (Also, keep in mind that virtually all of that real growth took place in the first four quarters of Abenomics.)

However, let’s look at the GDP implicit price deflator.

Hmm, the GDP implicit price deflator has averaged 1.42% in the last ten quarters which is the highest rate since 1993Q2. Of course this might be due to the fact that the consumption tax was raised from 5% to 8% in April 2014, except that the consumption tax was also raised from 3% to 5% in April 1997 and that didn’t lead to a sustained increase in GDP implicit price deflator inflation.

There’s one way to settle this. Let’s look at NGDP growth.

Yep, NGDP growth has averaged 2.27%, which is the highest rate since 1993Q3. That’s clearly not due to the consumption tax increase (that is, unless your model predicts that tax increases will be expansionary).

So it looks like the current round of Japanese QE has led to the greatest sustained increase in NGDP growth and GDP implicit price deflator inflation in 22 years, but it has only had an ephemeral effect on RGDP growth.

Where have I heard something like this before? Here’s Scott Sumner in 2011.

Just to be clear, it is quite possible (likely in my view) that Japan could get another 2% of RGDP by switching to a 3% NGDP target. But it would be a one-time gain, as their labor market got less rigid. Unemployment might fall to 2% or 3%, but trend growth shouldn’t change.

That sounds like an astute prediction to me.

How about 70’s and 80’s RGDP “trend growth” data?

Well, of course, 1970s and 1980s RGDP “trend growth” data eclipses everything since.

I can understand ADAS approach to see RGDP growth.

Rather, we can see backward example the economy under “not tight money”.

Just to be clear, then. They need strong supply-side reform to raise trend RGDP growth? All that raising NGDP growth does is to lower unemployment. A good thing, but not a great thing.

Well, to the degree that money is not superneutral, raising the rate of NGDP growth may have other benefits than just lowering the unemployment rate. But yes, if the goal is to raise Japan’s trend RGDP growth, supply side reforms will be needed.

Mark,

How is ephemeral RGDP growth and 2% RGDP growth the same thing?

Morgan,

Scott hypothesized that a 3% NGDP target for Japan might yield a one-time 2% bump in RGDP but no change in trend growth. That sounds rather transitory to me.

I believe your post shows that money is not superneutral only in small periods of time, let’s say, 4 quarters … it took a huge effort in NGDP growth change to create just one year of above average RGDP, and then, RGDP fell back to trend level …

Great post, but some comments.

1, Give QE a chance. It might need to be larger, or sustained for many years. BTW, tourism to Japan is up nearly 50% in H1 YOY, thanks to cheaper yen. The Nikkei 225 is up more than one-third YOY, and property values have done well.

2. Singapore is in a deflationary recession, and much of Asia is sagging. The Hong Kong stock market is down YOY. The Hong Kong dollar is pegged to the US dollar. Imagine if Japan still had a yen at 80 to the dollar.

3. The average Japan resident keeps $6,000 in cash (yen equivalent) outside of banks, in drawers or under the mattress (tufon). After 20 years of deflation, and bank fees, it makes sense to save in cash. Then to transact in cash to dodge the tax man. So what do the official figures capture? The above-ground economy, which may be stagnating while the off-the-books economy is booming.

BTW, if QE is super-neutral, then fine, the Bank of Japan can liquidate the entire Japanese national debt.

Interesting post. One point (nothing new, but I think worth mentioning):

The population growth gap between Japan and the US is 0.9 pp. Thus, 2.3% NGDP growth in Japan is comparable to 3.3% in the US. One more pp, and they should be at full throttle. (In fact, we could also consider that the prime-aged population growth gap is even wider and adjust comparisons accordingly.)

Pingback: TheMoneyIllusion » Japan prediction from 2011, revisited

Skeptical monetary policy is superneutral to RGDP in the long run.

Suppose the Fed decided in 1930 price stability and deflation were the right policy all the time, and set a 5% deflation target. Does long-term US growth look the same in this counterfactual?

Suppose after the Third Great Depression (2001-2014) the Fed finally decides maybe employment or growth should matter to monetary policy, and institutes 4-5% NGDPLT. Does all that lost growth “catch up” in a few quarters?

Snowballing effects in a market economy are hard to predict. I suspect there’s virtuous cycles lurking in NGDPLT somewhere.

Pingback: The Great Axis Stagnation | Against Jebel al-Lawz