Timothy B Lee summarizes thus:

This pattern — the Fed talking about imminent interest rate hikes but then delaying them due to disappointing economic performance — has been playing out for a couple of years. A lot of commentators simply treat it as bad luck, with the Fed as a mere spectator. But that misunderstands what’s going on.

In reality, the Fed’s constant chatter about raising rates is itself an important cause of the economy’s sluggish performance. Markets and business leaders pay close attention to Fed statements. When Yellen signals that higher interest rates — and, consequently, slower growth — are imminent, companies respond by cutting investment spending. The result is a self-defeating feedback loop.

Imagine if, from today, the Fed instead of “rate normalization”, began to talk about “spending level normalization”. Quite likely, a self-reinforcing feed-back loop would take hold. Instead of “slumming” we might just start “going somewhere”!

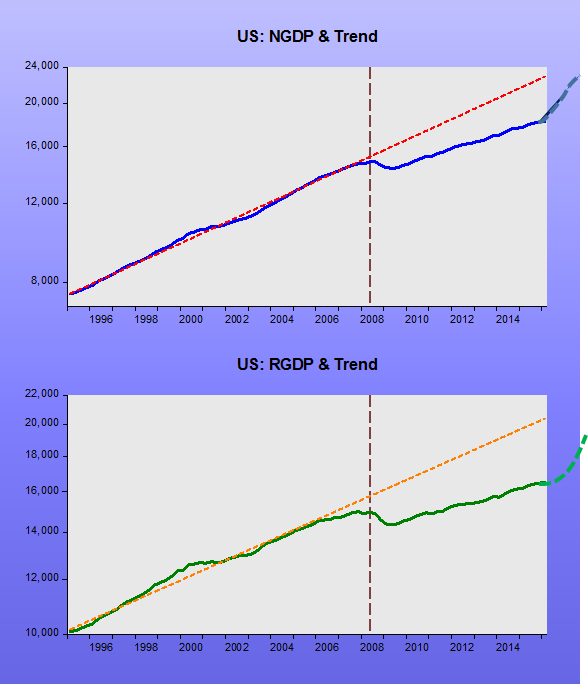

The RGDP one is implausible to the extreme.

Only if you, like Yellen, that the economy is at potential and that changes in future prospects cannot increase potential, just like the downgrading of prospects over the last 9 years have reduced potential!

I don’t think the downgrading of prospects of NGDP over the last 9 years has reduced potential RGDP. Only employment, and that only temporarily. I think the economy is close to potential.