A James Alexander post

With no one to blame but itself, Switzerland has slipped into negative YoY NGDP growth in the third quarter 2015.

The credibility-busting move of the hard money chief of the Swiss National Bank, Thomas Jordan, to abandon the ceiling vs the Euro in January led to a dramatic and mostly sustained currency appreciation.

One of the purported reasons was that the size of the SNB balance sheet had expanded too fast and got too large relative to Swiss GDP. Actually, the balance sheet hadn’t risen, or at least there had been no further EUR purchases, since the hard-fought battle to win credibility for the ceiling back in 2011 and again in early 2012.

There were also rumours of mysterious pressure on the SNB from some of the regional cantonal governments who supposedly relied on dividends from the central bank to support their budgets. The depreciation of the Swiss Franc had led to paper losses and suspension of the dividend. We will have to wait until later in 2016 for the 2015 accounts to see if the SNB is back making paper profits and paying a dividend.

On the abolition of the ceiling, the surge in the Swiss Franc was only controlled by further money creation. The balance sheet rose even further. We now have another quarter of data and see that these FX reserves are still climbing, as is the SNB balance sheet as the currency floats dirtily. Well done the SNB.

The third reason Jordan seemed to give was that he just couldn’t stomach further depreciation vs non-Euro currencies. For sure, as the Euro rose and fell relative to other countries so did the Swiss Franc.

Whatever the reason he’s ensured hard money and the currency has been stronger that it would otherwise have been. The evidence of further FX purchases comes from the fact that the SNB is still intervening to hold back the currency from even stronger appreciation.

Monetary tightening impacts Nominal GDP and thus Real GDP

And what is this tight money policy doing to the economy? The markets (and thus Market Monetarists) predicted it would lead to weak NGDP growth and that this would drag down RGDP. This is precisely what has happened with NGDP now in actual decline. Well done the SNB.

We’ve already commented on how weird it is that some people think this deflation is welcome. The Swiss don’t think so themselves.

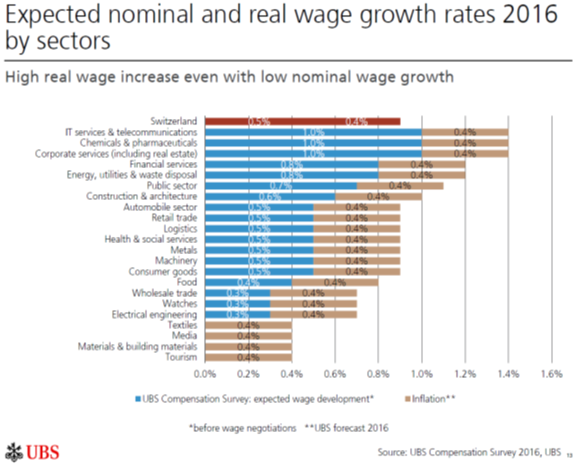

And declining nominal GDP can only be a bad thing for wages and for unemployment too. This UBS 2016 Swiss Compensation Survey has some fascinating charts, almost all highly supportive of the basic theory at the heart of Market Monetarism, low (or negative) expected Nominal GDP growth is a really bad thing given downwardly sticky wages. It sometimes feels as if it is the only useful insight of macro-economics.

You have to ignore the foolishly optimistic notion that Swiss workers will be enjoying their “high real wages” as their job security collapses. I say “nearly all” the charts are supportive as there is some room to reduce the bonus element of total compensation (Slide 15). And don’t forget Swiss unemployment is also impressively low by international standards, even if it is rising (Slide 7).