First, you get a “The Hero” magazine cover

First, you get a “The Hero” magazine cover

Then you get to be Person of the Year

Then you get to be Person of the Year

And finally, you write a memoir titled “The Courage to Act”

and voilá, the myth is born!

The latest invocation comes from Simon Wren-Lewis:

Here is an extract from an interview with Ben Bernanke by George Eaton in the New Statesman:

Though a depression was averted in 2008, the recovery in the US and the UK has been slow. Bernanke partly blames the imposition of fiscal austerity (spending cuts and tax rises), which limited the effectiveness of monetary stimulus. “All the major industrial countries – US, UK, eurozone – ran too quickly to budget-cutting, given the severity of the recession and the level of unemployment.”

Partly thanks to Bernanke’s leadership (and knowledge), the Great Recession was not as bad as the Great Depression of the 1930s. Monetary policy reacted much more quickly, and financial institutions were (nearly all) bailed out. In 2009 we also enacted fiscal stimulus, but in 2010 we reverted to the policies of the early 1930s with fiscal austerity. That mistake was partly the result of panic following events in the Eurozone (see the IMF analysis discussed here), but it also reflected political opportunism on the right.

However, as Scott Sumner concludes in a recent post:

That’s why it’s so important to get the facts right. Just as the Abe government showed the BOJ was not out of ammo in the early 2000s, a close examination of what the Fed did and didn’t do, and a cross country comparison of monetary policy during the Great Recession and recovery, shows that monetary policy is always and everywhere highly effective.

What are the facts?

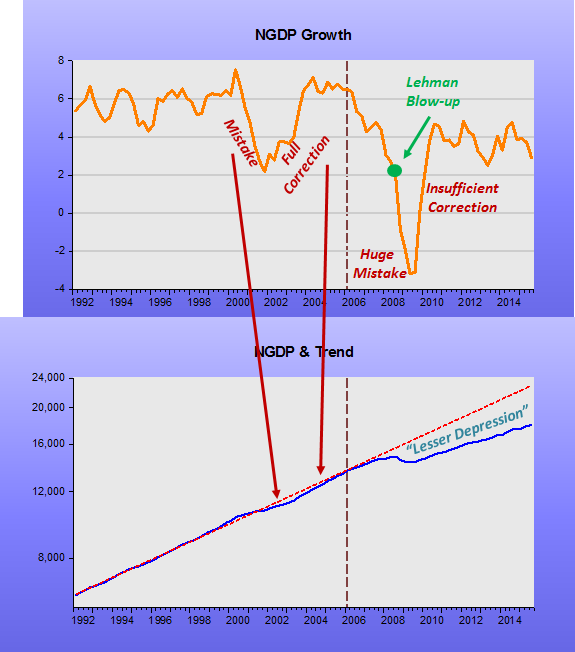

The chart shows that during the first few months of the Great Depression (GD) and the Great Recession (GR), the behaviour of NGDP was similar.

After that, things were very different. What Bernanke´s knowledge did was to apply the results from his “made my name” 1983 article “Nonmonetary effects of the financial crisis in the propagation of the Great Depression”, by going on a bank bail-out spree, thus avoiding the propagation factors that were very “active” in 1931/32.

The charts from the Great Depression indicate what Bernanke avoided. They also show that to get the economy to “turn around” and take a path back to the previous trend, monetary policy has to be really expansionary. That was true even with interest rates at the ZLB, as happened when FDR made a significant change in the monetary regime, cutting the link to gold in March 1933, almost four years after the start of the depression! NGDP growth went up by enough to put the economy on the path back to trend.

The next charts show what happened now. Notice that in the early 2000s, Greenspan also allowed NGDP to drop below trend, but that mistake was fully offset, and by the time Bernanke took the Fed´s helm. NGDP was back on trend.

Without going in to all the details, the fact is that Bernanke allowed NGDP to fall in “Great Depression style”. As mentioned, he avoided a second “GD” by bailing-out the financial system. In addition, by introducing QE in March 2009, monetary policy reacted much more quickly than in the “GD”.

However, notice the difference. In Bernanke´s case, monetary policy was just sufficient to put the economy on a growing trend along a lower level path. It never tried, as happened after March 1933, to get back to the original trend path. Thus, the economy is stuck in a “lesser depression” a.k.a. “Great Stagnation”.

And that really has nothing to do with fiscal policy.

“Bernanke partly blames the imposition of fiscal austerity (spending cuts and tax rises), which limited the effectiveness of monetary stimulus.”

It was the Fed’s decision beginning in 2008 to pay interest on reserves that limited the effectiveness of monetary stimulus. I suspect that had fiscal policy been more stimulative, monetary policy would have been less stimulative to offset fiscal policy.

Richard, and it was less stimulative in 2008/09, selling Treasury securities to fund it´s bail-out programs. In other words, saved the banks and screwed the people!

The Bank of Japan pays only 0.10% interest on excess reserves. They still have no inflation.

Great post, Marcus, I really dislike this “Cult of personality” that Bernanke has pushed with blog and book, and that is being pushed forward by the unopinionated media. Congrats on the good work. It clearly shows that Bernanke screwed up, saving the banks and forgetting monetary policy was a huge, paradigmatic, mistake. This criticism is important because it was generated by myopic views, and not an acceptable mistake when events unfold fast in an uncertain environment. That was not the case, you are showing it clearly.

Thanks. Unfortunately, the “screw-up” will never be fully acknowledged. At the moment, Yellen is about to fall in a trap of her own making!