…And they must be pretty dumb if they think otherwise! They talk about “normalizing” monetary policy as if there could be any other understanding that they want to put rates up. What does the market do? It pushes longer rates down!

For more than one year, ever since “the time is coming talk” began, the economy has been weakening. In that sense, the “TT” (“Tightening Tune”) strategy is working.

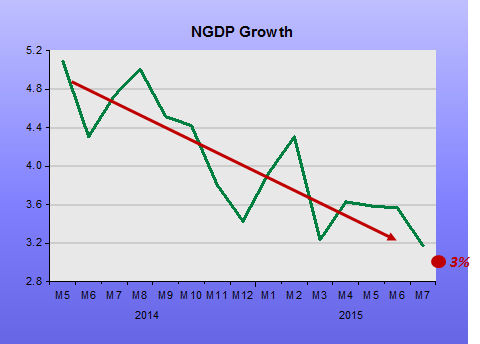

This is another example showing that the level of the FF rate does NOT define the stance of monetary policy. As seen in the chart, NGDP growth has been trending down for more than one year, which defines the stance of monetary policy much more precisely.

So I find it surprising that people who should know better feel baffled:

Chairperson Yellen’s remarks on September 24 mentions again that they could (expect to?) raise rates by the end of the year:

Most FOMC participants, including myself, currently anticipate that achieving these conditions will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter. But if the economy surprises us, our judgments about appropriate monetary policy will change.

The last sentence in the Yellen quote once again provides an out for the Fed not to do anything.

The bigger question is whether the economy is in a sustained recovery or have we hit a rocky spot giving the Fed further pause? That said, a return to normal monetary policy that begins to eliminate some of the distortions caused by several years of zero interest rates would seem to be beneficial and it is surprising that the FOMC did not see it that way.

Man, what do you mean by “not doing anything”? As I just argued, the Fed is in “tightening mode”. By actually raising rates they will be in “economy strangulation mode”!

Scott Sumner says:

Get ready for the new normal—3.0% NGDP growth—it’s coming soon.

As the chart above shows, we may be there already! Worse, if the Fed continues with the “TT” Strategy, it will bring it even lower.

PS Remember, in the “limit”, if there´s no labor force, there´s 0% unemployment!

I noticed one of my peeves in the quote:

“That said, a return to normal monetary policy that begins to eliminate some of the distortions caused by several years of zero interest rates would seem to be beneficial…”

That has never been convincingly qualified, let alone quantified. Since when is it beneficial to cause mass bankruptcy – for what? These people are cognitively challenged.

Bonnie, they´re full of “straw men” to rationalize their “views”!