The FOMC met concurrently with the release of the GDP report. Despite the far below expectations result the Fed remains steadfast:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Although growth in output and employment slowed during the first quarter, the Committee continues to expect that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

They sure expect a lot! Given the realizations of the past five years, I wonder how far they can extend their expectations!

Since the Fed is miles from practicing anything that could resemble an appropriate monetary policy, it will be surprising if their expectations are ever realized!

Some relevant pictures:

Note: FSDP = Final Sale of Domestic Product (excludes inventory change)

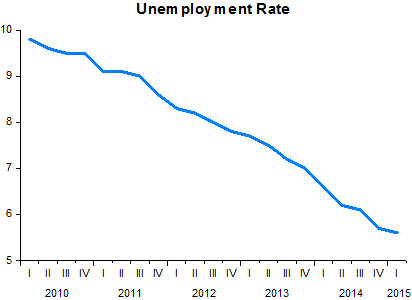

Nothing to worry about because “we are close to satisfying our other mandate”!

Hello, Marcus, a lot of analysts calling attention to the fact that there is a seasonality factor, 1st Q GDP has been always week in recent years, and it appears the intensity os this phenomenon has intensified. Do you have any thoughts on this? Abs

JRB, usually, when analysts “call attention” to things like seasonal factors, I figure it´s an “excuse” for forecasting errors! For example, back in 2007 Q1 , before the crisis, growth was also 0.2%, while in Q1 2006 it was 4.9%. In 2013, Q1 growth was 2.7%.

Usually, Q1 growth falls on the weak side. Without access to non seasonal data, it all becomes “speculation”.