And pointing to rising rates as monetary tightening (and falling rates as monetary easing).

Krugman writes:

What’s worrisome is that it’s not clear whether Fed officials see it that way. They need to heed the lessons of history — and the relevant history here is the 1990s, not the 1970s. Let’s party like it’s 1995; let the good, or at least better, times keep rolling, and hold off on those rate hikes.

Steve Williamson retorts:

Note that policy is actually tighter in 1995 than average Fed behavior over the 1990s predicts. But what if the Fed followed Krugman’s advice and behaved like it did in the 1990s? Well, the fitted Taylor rule, given an unemployment rate of 5.5% and a pce inflation rate of 0.2%, implies a fed funds rate of 2.8%. So if the Fed had been behaving like it did in the 1990s, it would have lifted off the zero lower bound long ago. Apparently Krugman is confused.

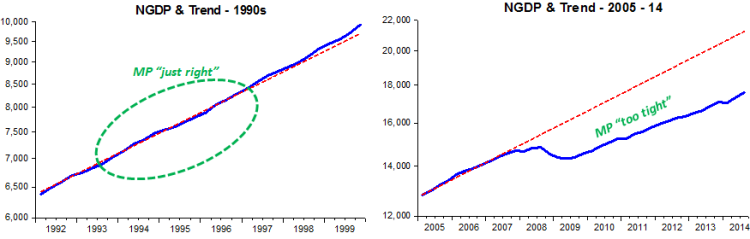

Monetary policy in 1995 was not “tight”. Just as monetary policy today is not “loose”. You get the appropriate answer by looking not at the change/level of the FF rate but by looking at NGDP relative to trend.

But if money is super neutral, and the economy is a Markov process, doesn’t that mean monetarism is a charade? About as relevant as chartism in picking stocks to buy…