I won´t mention Greece. It´s the Eurozone “free-rider” par excellence and will likely only leave the euro if expelled! Let´s take a more representative agent, Spain, whose people are beginning to consider “life outside the zone”.

Why´s that? The problem is best illustrated with the so called Meade-Swann diagram representing the internal and external balance conditions of a country. The figure illustrates.

On the vertical axis we have a measure of the real exchange rate, here defined as the ratio of the nominal exchange rate to the wage. In the case of Spain, being in the euro, there´s no way it can independently change the nominal exchange rate. The real exchange rate indicator used can be interpreted as a measure of the Spain´s “competitiveness” relative to, say, Germany. The horizontal axis measures aggregate demand (absorption).

The Internal Balance (IB) line represents points such that the combination of the real exchange rate and absorption are consistent with a measure of IB, here defined as unemployment at the “natural” rate. The External Balance (EB) line represents points such that the combination of real exchange rate and absorption are consistent with a measure of EB, here defined as a “balanced” current account (CA).

The figure is divided in four quadrants. Quadrant I depicts a situation where the country is running a current account deficit (D) and unemployment is above the “natural” rate (U). Quadrant III represents a situation of CA surplus (S) and “overheated” economy (O), one in which unemployment is below the “natural” rate, and so forth for the other quadrants.

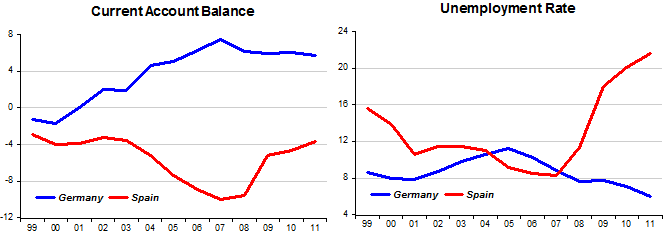

Spain is clearly deep inside quadrant I, running a CA deficit and with high unemployment. Let´s put Germany in quadrant III, running a CA surplus and with unemployment close to the “natural” rate. The charts illustrate the CA and unemployment situation in both Germany and Spain.

Notice that since the crisis began, Spain has reduced its CA deficit somewhat. In terms of the Meade-Swann diagram above, it has moved closer to the EB line, at the same time distancing itself from the IB line, i.e. unemployment has risen. Germany has made no move to reduce its CA surplus.

Germany´s position is “comfortable”, that being the reason it wants Spain (our “representative agent” for the “periphery”) to practice “austerity”. That means putting onto Spain´s shoulder the whole burden of adjustment.

Spain can acquiesce and tolerate high (and rising) unemployment for many more years, until wages are pushed down and prices are reduced. To many, Spain could also take measures to reduce costs through structural reforms and the improvement of infrastructure. But that takes an even longer time and there´s little chance that Spain could get the financing for infrastructure improvements. And I´m not even considering the political implications of “austerity”.

Germany (as representative of the “core”) could give a helping hand by taking steps to reverse the policies that led to the crisis. They can cut taxes in order to reduce domestic savings and increase domestic consumption. These measures would amount to an interval appreciation, raising wages and prices relative to Spain, thereby increasing Spain´s competitiveness and reducing its CA deficit for any given amount of “austerity”.

But Ms Merkel is the “nein, nein, nein” lady and people like Bundesbank President Jens Weideman would go crazy with the idea. To them what´s needed is more “austerity”!

To top it all, even if there are moves to increase the relative competitiveness of Spain, at the end of the day there will have to be measures to deal with the real increase in Spain´s domestic debt burden. That will arise both if Germany decides to help and “inflates” relative to Spain, which will force up euro interest rates, increasing Spain´s refinancing costs, or if Spain deflates, directly increasing the real debt burden. And how do countries faced with that problem act? They confiscate domestic savings!

At the end of the day, it is very unlikely that Spanish voters will accept high unemployment and an assault of middle class savings for as far as the eye can see without rebelling at the polls. Germany should come to its senses and realize that Spain simply cannot accept the full burden of adjustment.

Obviously the third option for Spain would be to leave the euro, reintroduce the peseta and devalue. But that´s another story.

On this topic, Paul Krugman provides the perfect quote:

“What’s interesting is that the euro itself created the asymmetric shocks that are now destroying it [via the capital flows it engendered]. Not only have they created something incapable of dealing with shocks but the creation engendered the shocks that are destroying it.”

Other good quotes:

From Tyler Cowen: It probably is about time to judge the euro zone as a failed idea — and rarely is it wise to double down on failed ideas.

From David Zervos (quoted by John Mauldin): A bank run is the only way to get to equilibrium in this system.

Pingback: Meade-Swann and how two simple lines perfectly illustrate the Eurozone conundrum « Economics Info

Pingback: Ben Bernanke is still in 'easy blogging mode' | The Corner

Pingback: Payday Links - June 1, 2019 - Fat Tailed and Happy