But that´s not what Austrian James Grant (of Interest Rate Observer fame) believes, according to his book “The Forgotten Depression: 1921: The Crash That Cured Itself” reviewed by the Economist:

THE economic slump that afflicted America in 1920 and 1921 was a nasty affair. Real output fell by some 9% and unemployment may have soared as high as 19%—the statistics are patchy—making it easily twice as bad as the so-called Great Recession of 2007-09.

Yet the slump is barely remembered, largely because it was eclipsed by the Great Depression a decade later. In his aptly titled book, James Grant, the founder of a well-regarded financial newsletter, has two missions: to bring this fascinating chapter of economic history back to life, and to demonstrate that a laissez-faire approach can cure slumps better than government activism managed in the 1930s—or indeed in 2008. He is more successful in his first aim than the second.

… By that point, though, the depression was ending. This is the crux of Mr Grant’s thesis that it cured itself, and that monetary and fiscal activism only made things worse in later downturns. But he makes too much of this. The Fed brought on the 1920-21 depression with high interest rates. Those rates drew in gold anew, which, along with deflation and political pressure, eventually caused the Fed to relent and lower rates. The slump and recovery were thus not the spontaneous product of the free market but of deliberate policy, much as in later recessions.

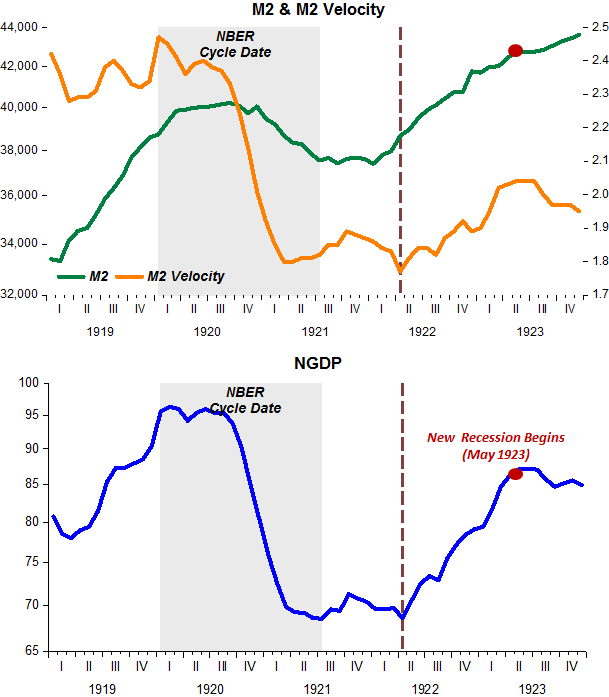

And as the charts indicate, the 1920-1921 depression (and the subsequent recovery) was very much of a monetary nature.

When money supply growth rises and joins hand with increasing velocity, NGDP “blossoms”. Since prices were pretty flat (after having dropped precipitously), the gains were mostly real. And in mid-1923, when monetary policy faltered again, a recession began!

For decades Grant said hyperinflation coming. I guess now his schtick is promoting central bank do-nothingism. It seems to me that Grant’s Interest Rate Observer letter was always predicting a surge in interest rates. That never happened. No wonder Grant hates the central bank.

I would like to bring to your attention what looks like a response:

http://tomwoods.com/blog/was-the-fed-expansionary-from-1921-1924/

Maurizio, this sentence “Fed policy was decidedly contractionary during the early recovery from 1921-1922 and significantly contractionary during the entire recovery from 1921-1924.” simply does not reflect what really went on, as my charts indicate. The Fed was clearly “expansionary” from early 1922 to mid-1923. At that point monetary policy was tightened and a new recession ensued!

The problem for the interventionists regarding 1920 is that the entire crisis was precipitated by a price, loan, investment and capital structure induced and facilitated by the violent government interventions employed to finance World War I. The crisis occurred because of the shift in policy after the war of slashing spending and inflation.

For the interventionist analysis to have any basis whatsoever, it must be based upon finding that elusive antecedent market failure which must be repaired by intervention. The problem for the interventionists is that THERE IS NO SUCH ANTECEDENT MARKET FAILURE. 1920 again demonstrates that crises are caused by intervention and cured by the market. That is why this episode is and must be suppressed from public knowledge. Krugman himself gave is seal of approval to a paper by uber-Keynesian Daniel Kuehn who therein inadvertently proved the truth of the Austrian narrative:

http://bobroddis.blogspot.com/2012/08/daniel-kuehn-provides-factual-basis-for.html