This article in The Economist – “Sea of Tranquility” – is intriguing:

A DECADE ago, the business cycle was an endangered species. Recessions in the rich world had become rare, shallow and short; inflation was predictably low and boring. Economists dubbed this the “Great Moderation” and gave credit for it to deft macroeconomic management by central banks. Such talk, naturally, ended abruptly with the financial crisis.

But obituaries of the Great Moderation may have been premature. Since America emerged from recession in 2009, its growth, although low, has been as stable as during the Great Moderation’s heyday, from the early 1980s to 2007, judging by the volatility of quarterly gross domestic product and monthly job creation. That, in turn, has pushed the gyrations of stock and bond prices to their lowest levels since 2007. The trend is less pronounced outside America, but economists at Goldman Sachs nonetheless find that pre-crisis levels of tranquility have returned in Germany, Japan and Britain.

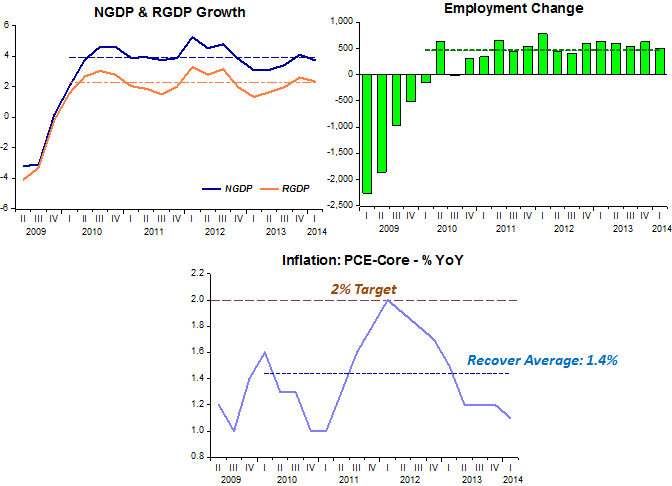

As the charts for real and nominal output growth, employment change and inflation show, this is quite true.

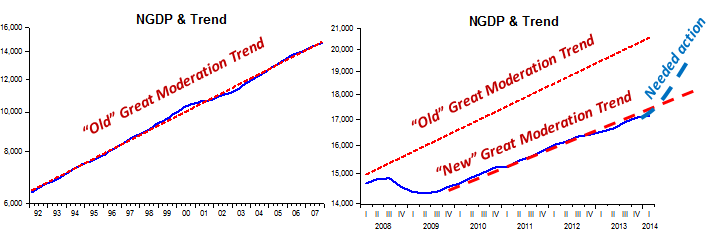

But now take a look at the NGDP & Trend chart for both the ‘old’ and ‘new’ “Great Moderation” trend level:

What the “Great Recession” did was take the economy to a lower activity LEVEL, which shows up as a break in the nominal spending (NGDP) process.

It´s almost as if the Fed was purposeful in its actions because if it can, by a gargantuan contraction in nominal spending bring the economy to a lower level and then keep it going at a ‘constant’ speed, it could, if the FOMC were able to stop bickering about imaginary inflation dangers, undo its mistake and take nominal spending to at least somewhere nearer where it originally was.

The rest of the article deals with the possibility that this new round of “Great Moderation” will also lead to excessive leverage and, you guessed, another crash.

It seems we´re destined to live through a Jules Verne “Voyage to the Center of the Earth” experiment and see how “deep” we can go (or fall).

Update: On “too much uncertainty” “too little uncertainty” valse see this Britmouse post:

In 2014 wise central bankers are now worried that there is not enough uncertainty – there may be that dreaded “search for yield” – or, as those cheeky capitalists like to call it, “higher investment”. This is a bad thing, because, well, there might be “bubbles” even if we can’t define what a bubble is or identify one until after the fact. And we’ll apply the usual post hoc ergo propter hoc fallacy, because there are things which went up in 2007 which also went down in 2008, ergo those things caused the recession in 2008. Even though central banks’ own models tell us that financial crises and recessions have a single common cause: bad monetary policy.

We can be sure of only one thing: whatever happens, central bankers will be quick to tell us it wasn’t their fault.