The WSJ has a piece which closely reflects the consensus view on the matter: “Japan´s Sales-Tax Boost will Test Abenomics”:

The tax increase is designed to pay for Japan’s ballooning social-welfare costs and to pare its huge public debt, which, at more than twice the size of the economy, is the largest among rich nations. But it comes at an inopportune moment for Tokyo, which hopes Japan’s cautious consumers continue to spend after more than 15 years of debilitating deflation.

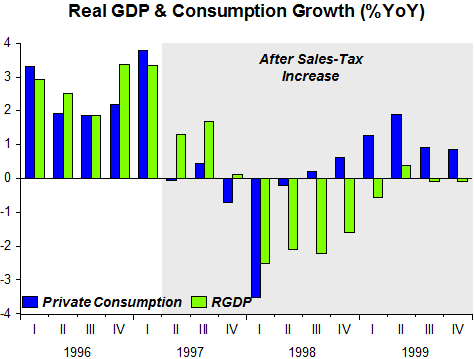

History isn’t reassuring. In April 1997, when the government last raised the sales tax, to 5% from 3%, consumption took a dive and—along with the effects of the Asian financial crisis—pushed Japan into deflation and a recession that lasted more than 18 months.

And shows a version of the chart below:

Inflation (core-core, which excludes fresh food and energy) temporarily jumped:

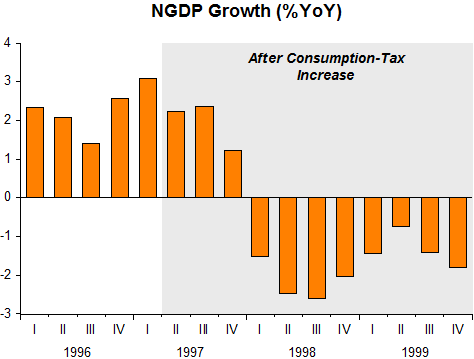

Given Japan´s implicit zero inflation target, monetary policy was severely constrained, with aggregate nominal spending (NGDP), something over which a central bank has close control, registering a sequence of negative rates of growth.

What if monetary policy had not worked to reinforce the contractionary effects of the consumption tax hike?

Given the “anti-deflation philosophy” of Abenomics, it is very unlikely that the BoJ will do an encore of 1997. In their evaluation of inflation they won´t validate the (temporary) increase in inflation to their 2% target.

The charts below show that after a string of negative inflation and NGDP growth, “Abenomics” appears to have reversed the trends. Now it´s up to Abe and Kuroda to “keep the flame burning”!

Pingback: Will the Increase in the Consumption Tax Derail Abenomics? | The Corner