Like a spoiled brat, Krugman stomps his feet and cries that it´s fiscal stimulus or nothing. Surely, he pays lip service to monetary policy but since we are stuck in his beloved liquidity trap-ISLM world, there´s almost nothing the Fed can do!

That surely has helped polarize the ‘debate’, so I feel not all is lost when I get to read something like this piece from Clive Crook:

In a column last week I criticized Paul Krugman’s apparent belief that people who disagree with him — let’s say about half the country — are knaves, fools or sociopaths. I said his disdain was not just absurd but also politically counterproductive. Krugman responded to my “screed,” as he called it. His main point was that the disagreement over fiscal stimulus isn’t really a political disagreement at all. On one side, you have people who accept some simple, uncontested facts; and on the other, you have people too knavish, stupid or sociopathic to understand when those facts are patiently explained to them.

In particular, he argued, the debate over the fiscal stimulus has nothing to do with the proper scale and scope of government — an issue on which he seems to concede (somewhat to my surprise) that reasonable people may disagree. Whatever you think about the proper scale and scope of government, he says, you should be willing to go for a big fiscal stimulus when interest rates are at zero and demand is lacking. This has nothing to do with values or ideologies.

In any event, the main point is that the composition of the stimulus dominated the discussion throughout, as Krugman insisted it should. That put divisive value judgments about the size and scope of government at the center of the quarrel. Not everything is political, as Krugman rightly says. But the stimulus debate was as political as it gets, and, in no small part, that was thanks to Krugman.

All this comes out clearly in Krugman´s May 6 column for the NYT, but I want to be specific in my comment, so I´ll concentrate on one of his favorite arguments, and show it´s misleadingly wrong. Krugman writes:

F.D.R. cut back sharply in 1937, plunging America into recession; the Recovery Act had its peak effect in 2010, and has since faded away, a fade that has been a major reason for a slow recovery.

Wow! In 1937 real government purchases recoiled 4.2% and the economy tanked. In 2012 real government purchases were 4.8% below the 2010 level and the recovery is slow!

Surely something is going on that´s making comparable ‘fiscal austerity’ so much less damning in 2012 than in 1937.

And that ‘something’ is monetary policy.

There are several studies that indicate that it was monetary policy that bore the major responsibility for the severity of the ‘recession within the depression’. My favorite is Doug Irwin´s Gold Sterilization and the Recession of 1937-38. The abstract reads:

The Recession of 1937-38 is often cited as illustrating the dangers of withdrawing fiscal and monetary stimulus too early in a weak recovery. Yet our understanding of this severe downturn is incomplete: existing studies find that changes in fiscal policy were small in comparison to the magnitude of the downturn and that higher reserve requirements were not binding on banks.

This paper focuses on a neglected change in monetary policy, the sterilization of gold inflows during 1937, and finds that it exerted a powerful contractionary force during this period. The transmission of this monetary shock to the real economy appears to have worked through lower asset (equity) prices and higher interest rates.

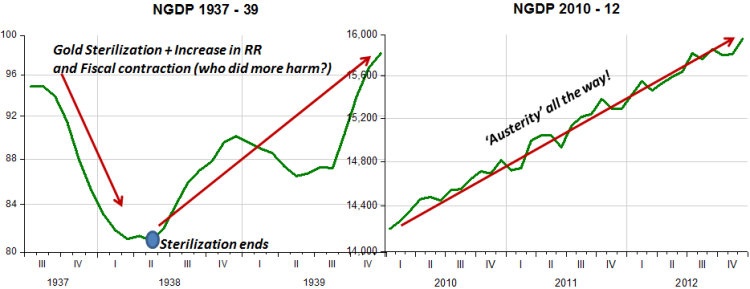

This is how the 1937 – 38 and 2010 – 12 versions of the ‘movie’ evolved.

While in 1937-38 nominal spending (NGDP) tanked (all the constraining factors are listed), in the 2010-12 version nominal spending keeps chugging along at a reasonably stable rate of 3.8%.

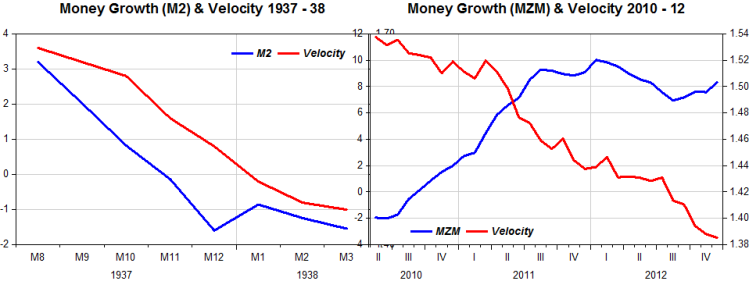

The next scene indicates that when the ‘monetary actor walked out of the set’ in 1937, spending shot down. And when it came back on set spending ‘shot up’ again!

The last frame compares an important scene from the two versions of the movie. In both, the ‘fiscal actor’ is refusing to ‘act’. In the earlier version the monetary ‘actor’ does not satisfy the demands of his ‘leading lady’ (money demand is rising/velocity falling) while in the new version he partly satisfies her ‘wishes’ so that spending keeps rising, albeit less than would be desirable. If only ‘he’ could give ‘her’ more ‘satisfaction’ the ending would be much ‘brighter’.

So I believe that Krugman, the NYT ‘film critic’ is desperately trying to bring back a ‘failed actor’ from retirement’. He would be much more helpful if he focused on ‘coaching’ the ‘leading man’ into an ‘Oscar performance’.

PS. This is how a monetary policy ‘guitar’ should be played: Beautifully and widely applauded:

http://www.youtube.com/watch?feature=player_embedded&v=8Pa9x9fZBtY

Update: Suggested reading for Krugman:

We document that current views about the causes of the Depression were anticipated in the 1920s by Ralph Hawtrey and Gustav Cassel who independently warned that restoring the gold standard risked causing a disastrous deflation unless the resulting increase in the international monetary demand for gold could be limited. Although their early warnings of potential disaster were validated, and their policy advice after the Depression started was consistently correct, their contributions were later ignored or forgotten. This paper explores the possible reasons for the remarkable disregard by later economists of the Hawtrey-Cassel monetary explanation of the Great Depression.

Marcus, as you point out in your book, it took Krugman’s hero Samuelson about 35 years to finally come around to Friedman’s views. I’m sure that once Krugman’s an old geezer and no longer holding the megaphone he’ll acknowledge you guys were right all along.

By the way, I know you guys (market monetarists) like the EMH, or at least think it’s a useful barometer (i agree), but you guys seem unaware how much profitable investment advice you’ve been giving. Each time you guys say something like “Country X’s central bank isn’t going far enough, but these are steps in the right direction”, country X’s stock market rallies STRONGLY for the subsequent 6-12 months.

You guys are too modest and rational to trade on your insights though?

Brendan. Interesting comment. That´s why I said some posts back that Bernanke was a great advisor but lousy executor. My partner does the trading. I stick to the analysis/insights! And he is not obliged to follow them. The important thing is that we always ‘discuss’.

“Whatever you think about the proper scale and scope of government, he says, you should be willing to go for a big fiscal stimulus when interest rates are at zero and demand is lacking.”

Not when the Fed is targeting inflation, the price level, or NGDP. In that case, we would only be reallocating resources from one bucket to another with a big warning label attached that says: Put resources here and they will be allocated forever, and become more demanding over time. Krugman’s entire argument is about allocation of resources, not macro necessity for getting out of this hole; and I am not interested in the inefficiency of government allocating huge amounts of resources forever.

Why doesn´t he run for Congress?

Pingback: TheMoneyIllusion » Nunes on Krugman

Nunes is the best economic historian of the USA I know of…and he is Brazilian!

Well, sometimes national pride has to take a back seat to what is real….

Marcus I like you and your analysis but you and Sumner have this congential issue with Krugman. What makes him a ‘spoiled brat’ because he asks for fiscal stimulus? Does asking for something that you’re not getting make you a spoiled brat? Then you MMers are in the same boat.

You say his calls for monetary policy are just lip service. At least he pays it lip service which is more than I can say for Market Monetarists regarding fiscal policy.

It’s not so much the asking imo, more the stomping of the feet and the insistence that monetary policy is impotent at ZLB.

Why would you expect MMs to advocate a fiscal policy that will probably make things worse in the long run? It should be relatively obvious by now that the best policy is a balanced budget and NGDPLT.

I see no reason why you can’t have both. It’s MMers who have this doctrine of a zero mulitplier.

But do you need to? Or is it just to satisfy the ‘kid´s wishes’?

This post caused me to reread E. Cary Brown’s “Fiscal Policy in the “Thirties: A Reappraisal” (American Economic Review, Vol. 46, No. 5, December 1956, pp. 857–879) and Larry Peppers’ “Full Employment Surplus Analysis and Structural Changes” (Explorations in Economic History, Vol. 10, Winter 1973, pp. 197–210), both of which are mentioned in Douglas A. Irwin’s excellent paper on gold sterilization and the recession of 1937-38.

Peppers’ paper shows how to calculate cyclically adjusted budget balances from Brown’s paper. By my arithmetic, according to Brown’s data the cyclically adjusted general government balance increased by 3.0% of potential GDP in calendar year 1937. Peppers only looks at the federal budget, and he finds that the cyclically adjusted federal government balance increased by 3.5% of potential GDP in calendar year 1937 and another 0.1% in 1938 for a total of 3.6% of potential GDP.

According to the April 2013 IMF World Economic Outlook (WEO) the U.S. general government structural (cyclically adjusted) balance will increase by 3.9% of potential GDP between calendar years 2010 and 2013. And the March 2013 CBO estimates of the cyclically adjusted federal budget balance show it will rise by 4.6% of potential GDP between fiscal years 2009 and 2013.

So apparently we have repeated the fiscal mistakes of 1937 with approximately a 30% bonus and yet the economy has not plunged into a renewed depression.

Still looking in vain for that darned liquidity trap Krugman keeps talking about!

Mark, when you started with all the detail I thought “Hell, he´ll conclude I was off”. Thanks, no!

Pingback: Is the Fed able to offset “austerity”?

Pingback: タイラー・コーエン 「1937年の再現?」(2010年6月20日)/「Fedは財政緊縮の効果を相殺できるか?」(2013年5月10日) — 経済学101

Pingback: A Sumner-Krugman Proxy War? | Last Men and OverMen

Pingback: Marcus Nunes Accuses Me of Lying | Last Men and OverMen