This morning Charles Bean, Deputy Governor of the Bank of England, took the opportunity of the NGDP release for the last quarter of 2012 to ‘deride’ NGDP targeting. I don´t really recommend reading his speech because it is an ‘unlearning’ process, and the ‘innocent’ would come out of it ‘worse-off’! He makes the mistake of first discussing the pros and cons of an NGDP growth target. In the second part he deals with level targeting.

Anyway, the FT/Alphaville has a summary, I´ll just focus on a couple of points and counter argue with illustrations (my bolds):

So the deviations of nominal income growth from around 5% appear to have been largely associated with forecast errors. In particular, the collapse in demand after the demise of Lehman Brothers was so sudden and deep that there was no way that monetary policy could in practice have been relaxed early enough, and by a large enough amount, to prevent it. It is, though, a moot point whether policy would have been set even more stimulatory during the latter part of 2009 if we had been operating under a nominal income growth target, given that we were implicitly expecting a rather slow recovery in nominal income growth. Given how stimulatory policy already was, I suspect that we might well have taken the view that it was simply not feasible to get nominal income growth back much faster.

This is one of the more ‘self-serving’ paragraphs I´ve read in some time. It was all due to the surprise of the Lehman shock. And later there was not much the BoE could do even if operating under a nominal income growth target because we were implicitly expecting a slow recovery in NGDP growth! Yes, Mr. Bean, the BoE has no influence at all on nominal spending. Could it be that exactly because you were expecting a “rather slow recovery in NGDP growth’ that growth turned out indeed slow?

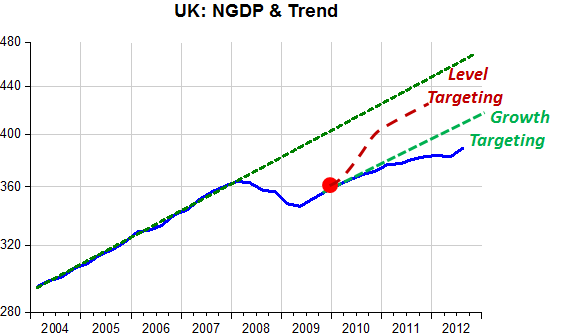

The charts below, which are two ways of showing the same thing, indicate that your Lehman ‘excuse’ does not hold water. By the time Lehman ‘folded’ NGDP had dropped way below the trend level path or, what comes to the same thing, NGDP growth had already fallen way below the 5% ‘target’. Could be that Lehman was the first ‘famous victim’ of the monetary policy folly that was taking place on the other side of the ‘pond’?

You could have ‘capped’ the depth of the hole by allowing NGDP to grow at 5% after late 2009, but you didn´t, and that´s certainly not a “moot point”.

“Anyway, he basically doesn’t believe that a shift to a nominal income growth target would represent a major change in the regime. Now to a shift to a target for the level of nominal income”.

… such a target would ensure that past control errors have to be subsequently corrected. Bygones are not bygones, in other words. In the current context, this is usually taken to mean returning nominal income to a continuation of its pre-crisis trend line. As Chart 3 reveals, the nominal income shortfall in the United Kingdom is presently very large – in excess of 15% in fact.

Such history dependence in policy is potentially of value when private agents are sufficiently forward-looking and the regime is fully credible…

The problem is that such a policy is not time-consistent. The central bank has the incentive to say that it intends to do this. But once tomorrow comes, it makes sense not to go through with its promise of holding policy tight, as it suffers a cost in terms of output foregone, while the benefit has already been gained in the earlier period. It is better simply to renege on the earlier promise to keep policy tight for a while…

Oh, spare me! The time inconsistency argument is so lame. First because any monetary policy target is ‘time inconsistent’ if the central bank, responsible for defending the target, has no credibility. If it does have credibility (a conquest of several central banks over the past 25-30 years) deviations from the target path will never be big. If they are it is because the central bank ‘slept at the wheel’.

To your credit, although the UK economy had for long (since 1992) been ‘travelling’ along the same ‘spending route’, I cannot say you ‘slept at the wheel’ because that was not your target. But if there´s a lesson to be learned from this episode is that you had the ‘wrong target’. If it were a ‘good target’ it would not have driven you astray, way into the ‘soup’!

Update: A sense of humor is always important. And thanks to Steve Grissom we can get a good laugh watching Mr Bean steer the economy (see in comments).

Pingback: ‘Bean counting at the BoE’ | Fifth Estate

Mr. Bean, on steering the economy:

Pingback: How Tight Money and Fiscal Stimulus Failed in 2008 | uneconomical