The FOMC transcripts for 2007 are out. I call them the “Hors d´oeuvre” to the “main course” dishes – the transcripts for 2008 and 2009 – which will be out in one and two years’ time, respectively.

I took a look at the transcripts from September to December. In the September meeting the FOMC reduced the FF rate by 50 b.p.

In the October meeting, Mishkin had this to say:

We need to emphasize that it’s not just the upside risks to inflation but also the downside risks to the economy that have lessened.

What is key is that the response to our actions on September 18 was almost textbook perfect in the sense that the markets really got the message that we were not going to be asleep at the wheel.

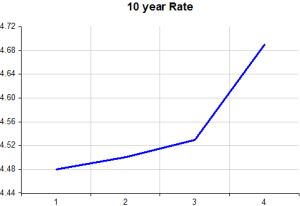

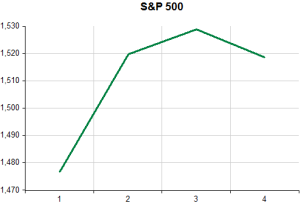

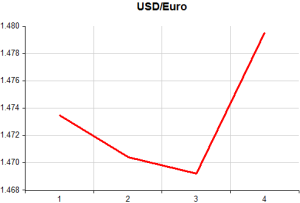

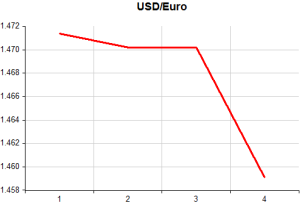

This was the market response as reflected in long term interest rates, the S&P 500 and the dollar exchange rate relative to the euro (from one day prior to two days after the release of Statement).

Things began to unravel at the December meeting. Mishkin had turned very pessimistic:

The bottom line is that my modal forecast is certainly down, very much along the lines of what the staff has suggested. But I think there is a significant probability that things will go south. You don’t like to use the R word, but the probability of recession is, I think, nearing 50 percent, and that really worries me very much. I also think that there’s even a possibility that a recession could be reasonably severe, though not a disaster. Luckily all of this has happened with an economy that was pretty strong and with banks having good balance sheets; otherwise it could really be a potential disaster. I don’t see that, but I do see that there is substantial risk that the economy could have a severely negative hit to it that would be very, very problematic.

And regarding inflation, he was an “outlier” among participants:

That’s where I think inflation expectations are grounded, and I see no tendency at all for things to get much worse in that regard. I’m not saying that couldn’t change, and so I think we have to be very vigilant. But in the current environment, where I see a very negative potential path of the economy, the idea that inflation is our primary concern right now is not where I am. With that let me end.

Mishkin favored a 50 b.p. cut but thought the Committee would not go for it:

In that context, I think that the issue of macroeconomic risk is really a severe one, and an action of 50 basis points could help deal with that risk. So I would prefer alternative A. If the Committee were going that way, which it is not…

Bernanke had these concluding words:

If the choice were between 0 and 50 basis points, I would be very tempted to do 50 basis points. I think it would move us more toward accommodation, and it would be very pleasant to get the same kind of market response we got after September in terms of improved functioning and credit extension. That said, I think there are some risks to going with 50 basis points. I acknowledge what others have said, which is that it is not just about the rate but also about what the message is. In particular the markets already expect us to ease quite a bit more. We are not pushing strongly back against it with 25 basis points. If we do 50, we may be saying to the market that we are willing to do even more than you currently expect. I think that poses some risks to inflation expectations and poses some risks to the dollar, which is a little fragile right now.

You can imagine it even having reverse effects with respect to the economy—for example, if it caused oil prices to jump or if it caused nominal interest rates to rise, thereby raising nominal mortgage rates. The other concern I have is that, for better or worse, given our communications and market expectations, at this point a 50 basis point cut would be viewed as something of a lurch and might signal, as others have suggested, more concern or private information about the economy that we in fact don’t necessarily have. You can tell that I am quite conflicted about it, and I think there is a good chance that we may have to move further at subsequent meetings. In that respect, it is very important that both in our statement and in our intermeeting communications that we signal our flexibility, our nimbleness: We are not locked in, we are responsive to conditions on both sides of the mandate, and we are alert to new developments.

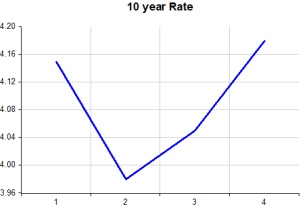

The markets were negatively surprised, as indicated by the long rate, the S&P and dollar/euro exchange rate.

Interesting that in an unscheduled January 21 2008 meeting the FF rate was reduced by 75b.p.!

And it´s a pity that according to the 2008 statements Bernanke and the FOMC became increasingly worried about inflation. I´m curious to read, next year, on Mishkin´s reactions, given that in late 2007 he was so adamant about inflation expectations being anchored.

In his comment Mishkin had also said:

I feel strongly that the one thing a central bank can never afford to do is to lose its nominal anchor. If we do that, it’s a disaster. With that viewpoint, I should say that, if shocks occurred such that recession was going to occur and the only way we could stop a recession from occurring was to inflate the economy, we couldn’t allow that to happen. We actually have to preserve the nominal anchor because, in the long run, the pursuit of price stability is what makes good monetary policy and has been a key reason for the remarkable success of monetary policy by the central bankers throughout the world in recent years that I think nobody would have predicted.

That´s the problem with “inflation targeting”, you talk about “inflation and inflating”. If they were pursuing a NGDP level target they would say: “to avoid a recession occurring we will strive to maintain the economy evolving in a stable fashion along the level nominal growth path”.

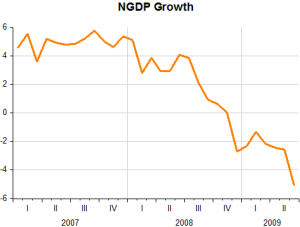

And the chart below (monthly NGDP data %YoY from Macroeconomic Advisors) shows that´s exactly what was happening throughout 2007. Unfortunately “strong antiinflation sentiment” took over in 2008, propelling nominal spending (and with it the economy) south!

Great post, thanks for sharing.

“With that viewpoint, I should say that, if shocks occurred such that recession was going to occur and the only way we could stop a recession from occurring was to inflate the economy, we couldn’t allow that to happen. We actually have to preserve the nominal anchor because, in the long run, the pursuit of price stability is what makes good monetary policy”

Umm yeah, good monetary policy for the sake of monetary policy – forget the millions of people who are ruined in the process. I’ve been pretty hard on this Mishkin guy without any “smoking gun” – and this just confirms my suspicions.

And I forgot the most important part – would a need to reinflate mean that it had to disinflate which wouldn’t have been “price stability” in the first place? Adding the words “long run” don’t really help him either because at least the legislative mandate is for the long run – meaning if the target is 2% and they get -4%, they have to make up 6% – yes?

DJ, note that Mishkin was the “reasonable” guy in the FOMC! It just shows how bad a target inflation really is.

Bernanke: “You can imagine it even having reverse effects with respect to the economy—for example, if it caused oil prices to jump or if it caused nominal interest rates to rise, thereby raising nominal mortgage rates.”

Good thing we had a financial crisis, to keep oil prices and mortgages rates down, and strengthen the fragile dollar. Otherwise the economy might have been hurt.

Grrrrrrrr…..

Grrrrrrrr…indeed!

Pingback: Former Fed Governor Mishkin and the Crime of the Century « dajeeps

the one thing a central bank can never afford to do is to lose its nominal anchor

The nominal anchor is the 2% target, right?