While enjoying the warm weather of Zanzibar, off the coast of Tanzania, Jeffrey Frankel has come out, once again, in defense of NGDPLT targeting.

But this time I want to criticize one point he makes in an otherwise almost flawless piece:

A nominal-GDP target’s advantage relative to an inflation target is its robustness, particularly with respect to supply shocks and terms-of-trade shocks. For example, with a nominal-GDP target, the ECB could have avoided its mistake in July 2008, when, just as the economy was going into recession, it responded to a spike in world oil prices by raising interest rates to fight consumer price inflation. Likewise, the Fed might have avoided the mistake of excessively easy monetary policy in 2004-06 (when annual nominal GDP growth exceeded 6%).

The bold sentence above indicates that he forgot, temporarily, that it´s supposed to be a LEVEL target, not a GROWTH target (although if you are on target the growth rate of NGDP should be ‘constant’). Saying that monetary policy was excessively easy in 2004-06, because NGDP growth exceeded 6%, is a mistake even some bona fide market monetarists entertain. And the bad part about it is that it gives credence to those like John Taylor, among others, who point to the “easy” monetary policy over that period (“rates too low for too long”) as an important cause of the housing bubble and bust and the ensuing “Great Recession”.

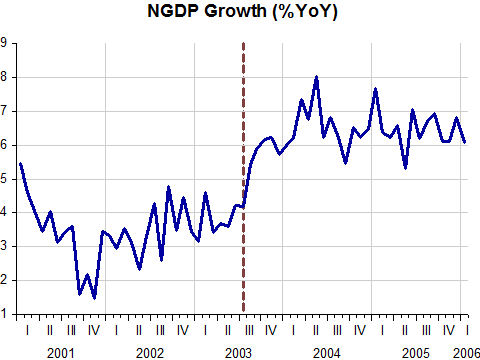

I´ll try to show, through some charts, that that´s very far from the ‘truth’, and that monetary policy in 2004-06 was ‘exactly right’ (in the sense that it brought NGDP back to the target level.

The first chart shows the NGDP gap between 2001 and 2006. The reason for the dotted line over mid-2003 will become clear soon.

The only way NGDP can climb back to trend, as it did by early 2006, is if NGDP grows temporarily above the trend growth rate (about 5% at the time).

The question is: Why did it happen after mid-2003? The answer lies in the Fed having been successful in its forward guidance policy (something which it has been trying to repeat of late, and now adding thresholds, without much success).

In the May 2003 FOMC meeting there were already indications that monetary policy could change.

In the next FOMC meeting, in June, unknown at the time to the general public, Vincent Rinehart (Director of the Board´s Division of Monetary Affairs) made a presentation called Conducting Monetary Policy at Very Low Short-Term Interest Rates”. The post- meeting statement read:

The Committee perceives that the upside and downside risks to the attainment of sustainable growth for the next few quarters are roughly equal. In contrast, the probability, though minor, of an unwelcome substantial fall in inflation exceeds that of a pickup in inflation from its already low level. On balance, the Committee believes that the latter concern is likely to predominate for the foreseeable future.

This signaled that a change in policy was likely in the near future. That came about in the next FOMC meeting, in August 2003. The post-meeting statement said:

The Committee perceives that the upside and downside risks to the attainment of sustainable growth for the next few quarters are roughly equal. In contrast, the probability, though minor, of an unwelcome fall in inflation exceeds that of a rise in inflation from its already low level. The Committee judges that, on balance, the risk of inflation becoming undesirably low is likely to be the predominant concern for the foreseeable future. In these circumstances, the Committee believes that policy accommodation can be maintained for a considerable period.

Interestingly, at the top of Reinhart´s alternatives for monetary policy at low rates was this one:

Encouraging investors to expect short rates to be lower in the future than they currently anticipate.

Although the FF rate didn´t change, remaining at 1%, the new words, more recently labeled forward guidance, did the trick!

Interestingly, as the next charts show, all that we want to see happen now happened then.

Real growth went up significantly and unemployment began a solid downtrend.

Long term Treasury rates and the S&P 500 stock index reversed direction.

And medium term (5 years) inflation expectations also stopped falling and began to rise.

Rising NGDP and NGDP expectations did the “trick”. Later, Bernanke´s Fed let NGDP and NGDP expectations drop and then tank. Now, the only way to reverse the situation is to adopt, like the UK is on the way to do, an explicit NGDP-Level Target. But that will likely require a change in leadership, which is set to happen in early 2014.

Pingback: Jeff Frankel repeats his call for NGDP tageting « The Market Monetarist

Wonderful and strong post.

I do have a question: Should the Fed be responsible for every “bubble”?

Or is that like blaming the bartender for drunks in the house? And not the drunks?

Is the private-sector capable of manias, or booms, that are unrelated to Fed policy?

Or is real estate sui generis, in that it allows such leverage in the purchasing and investing thereof?