A couple of days ago Scott Sumner put up a post on “What successful monetary policy looks like”. The showcase was Sweden.

I travel over the “day line” to try an “experiment”, comparing Australia and New Zealand where both countries, like Sweden, belong to the Small Open Economies (SOE) group of countries. While in the case of Sweden it´s all about sophisticated capital and input goods, in Australia and New Zealand it´s all about commodities.

How do these two economies compare in the conduct of monetary policy, remembering that both adopt the “inflation targeting” approach to MP?

The comparative analysis is done for two distinct periods: 1997-99 that contains the Asian Crisis and 2006-2010 that encompasses the commodity boom-bust-boom within the world financial crisis of 2008-09.

The first picture gives a good characterization of both countries, showing the long running close relationship of their exchange rates against the dollar and commodity price index. It´s hard to distinguish exchange rate movements between the two countries.

Although hard to distinguish, the interpretation of this process by the Reserve Banks of each country was very different in the late 1990´s. The Reserve Bank of New Zealand adhered to a strict Monetary Conditions Indicator (MCI) according to which any depreciation of the NZ$ had an expansionary/inflationary impact (i.e. tantamount to policy “easing”). The Reserve Bank of Australia was much more pragmatic, trying to interpret the “nature” of the shock, in this case a negative shock to the terms of trade from the Asia Crisis, which tended to be contractionary/deflationary.

The following set of pictures show the behavior of exchange rates and commodity prices, the MP action described by the policy rate and what happened to real growth and inflation (headline and core) in both countries. No contest, Australia “wins” hands down!

Ten years later, with the accumulated experience, New Zealand had become more “flexible” in its policy decisions, but not “smart” enough to “beat” Australia in the game!

The next graph shows the exchange rate-commodity price relationship from 2006 on. Up to mid 2008 the commodity price boom is closely associated with appreciation of both exchange rates, as expected.

The following pictures show that this price boom was responsible for the rise above trend in nominal expenditures in both countries, more so in Australia. So, even though policy rates were being raised MP was “easy” during this time.

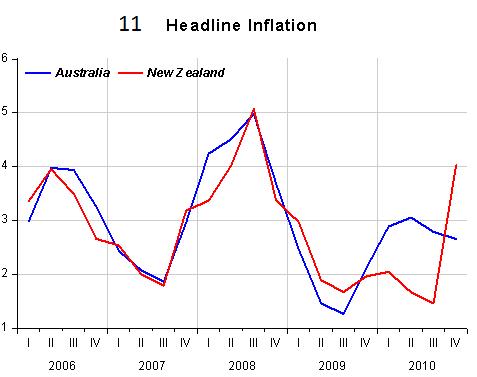

I surmise Australia´s short run supply curve (SRS) was quite steep. For similar growth rates in Australia and New Zealand, Australia experienced inflation (as seen from similar peaks in both headline and core), which was not the case in New Zealand where core inflation remained relatively flat. (At this time Australia´s unemployment was at an historical low of 4%, indicating the economy was operating close to full capacity).

The big difference shows up when the “sh… hits the fan” in mid 2008 with nominal spending in the US falling through the floor. Commodity prices dropped significantly and the exchange rate depreciated in tandem. While in New Zealand real growth turned negative, Australia only experienced a real growth slowdown.

In Australia nominal spending growth turned strongly negative, but that reflected mostly the fall in inflation, a very different outcome from what was seen in both the US and UK, where the fall in nominal spending mostly reduced real growth.

Good MP in Australia shows up in the period leading to the crisis, when it did not go “all out” (or as intensively as New Zealand) to constrain the rise in nominal spending from the commodity price boom. So when the crisis came it was well positioned to “calibrate” the drop in nominal spending so as to keep it close to the trend level. Unemployment went from 4% in early 2008 to 5.8% in September 2009. Now it stands at 5%, the same as in early 2006, when the boom was in full swing.

The commodity price boom is back on and the RBA continues to reflect on it.

So, grading on a curve, the RBA gets an A!

great analysis but i would add that-

1. the nature/demand of exports from these two also have an impact. AUD now runs trade surplus which i don’t think is the case for NZD.

2. the housing market continued to accelerate in recent years in AUD due to government incentives, availability of credit and wages

3. the household debt level (and indeed if i am not mistaken aggregate debt level) for NZD has for a long time been in a far more precarious condition

is the RBA framework better than RBNZ? yes, and its also been one of the better run central banks around. but AUD has also been fortunate versus NZD on a lot of levels due to the structure of its economy, scale and trade ties. of course now, it is very dependent on what happens with growth in china.

looking at you graphs of NGDP … looks like NZD has room to cut rates … which is what the market is pricing with the opposite being case in AUD.

muito obrigado pelo blog e informacao

Bertusmaximus

As Scott Sumner mentioned and you “itemize”, there could be some real factors helping to explain the very different outcomes, I agree, but I am sure (as you) that the conduct of MP by the RBA is much more

“productive”.

Pingback: Bernanke is terrified of deflation | Historinhas

I think it is much too early to assess the performance of the RBA in relative and absolute terms. There appears to me to have been a good deal of complacency and self-congratulation amongst RBA staff – the most absurd arguments being that both the high share of investment in GDP and the fact that mortgage arrears were presently low meant that the basic foundation of the Australian economy was very sound, and not at all like the awful situation in the US.

The point about commodity-driven economies is that their performance reflects the long swings in commodity prices and therefore their terms of trade that we observe. In the beginning of the upswing in commodity prices the old, grey-haired dinosaurs of men still left in the sector remember the previous dark days and repeated disappointments and are very cautious with regards to planning for expansion. By the end of the upswing, the commodity sector has become very glamorous and is populated by entrepreneurial risk-takers with only bright visions of the future; this extends to the whole economy, and is reflected in consumer leverage as well as that of firms.

Let’s see how well Australia performs when both commodity prices and the global economy see a downturn – I suspect there may be rather an abrupt revision of the popular assessment of its performance, with people benefiting from hindsight critiquing the RBA for running a too-loose monetary policy and failing to exercise adequate prudential control.

Time will tell. But I am not a buyer of the RBA’s reputation.

At least one thing in common: Our blogs have the same set up!

Australia is a “funny country”. It “did it” in the late 1990´s and again at present.So hedge your bets on Australia.

Pingback: TheMoneyIllusion » One economic lesson from Sweden

Pingback: One economic lesson from Sweden-Economic News | Coffee At Joe's

Always love your graphs 🙂

Pingback: Australia and New Zealand in monetary policy » TVHE