David Beckworth has a very good post: “The Origins of the Eurozone Monetary Policy Crisis”:

I made the case in my last post that the Eurozone crisis was largely a monetary policy crisis. That is, had the ECB lowered interest rates sooner and begun its QE program six years ago the fate of the Eurozone would be more certain. Instead, it raised interest rates in 2008 and 2011, waited until this year to begin QE, and allowed inflation expectations to drift down. In short, had the ECB been more Fed-like the Eurozone crisis would have been far milder.

This begs the question as to why the ECB failed to act more Fed-like. Why did it effectively keep monetary policy so tight for so long?

For that question he provides a long answer. I´ll boil it down to two panels.

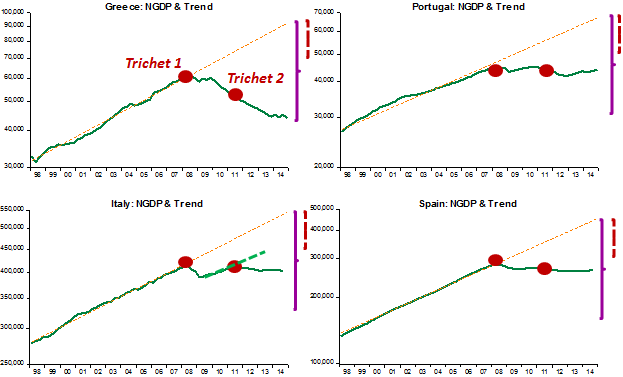

In panel 1 we have the behavior of NGDP relative to trend in 4 “core” countries (you may consider France “borderline”).

From this panel one could infer that the ECB (led by Trichet at the time) was setting policy in order to keep Germany, and only Germany, close to trend. When he increased rates in July 2008, Germany was the only core country above trend. In April and July 2011 Trichet raised rates again. Why? Because Germany, and only Germany, had climbed back to trend!

The negative effect of the 2011 rate rise was stronger in France than in the other core countries. France was on a “slow train” (compared to Germany) back to trend (green dashed trend line). Trichet, a Frenchman, threw France “off the train”!

You can imagine what the German-centric ECB actions did to the “periphery”. You don´t have to, just take a look at panel 2, that contemplates 4 peripheral countries:

Greece was “murdered”! Italy suffered with the 2001 rate rise. It was on the same “slow train” as France, but got ejected!

The amount of monetary tightening experienced in the “periphery” was an order of magnitude stronger than the tightening experienced by the core countries, and in Greece, it was about double the tightening experienced by its “peers”!

Bottom Line: “This is not a monetary union“. As is, the euro is unworkable.

The Beckworth post would be better as exhibit A for why the Taylor Rule is a bad rule that appears to justify the 2011 rate hikes. I really like Beckworth, but the rest of post isn’t something I find helpful.

Bonnie, I prefer the “devil” to a “Taylor-rule”! MMs don´t have any business dallying with TR´s

What is going on with the compression of the scales on the Y axis? Makes it very difficult to look at the slopes. The France NGDP on the top right is just painful, 390-400 wide and then 400-490 is smaller???? Fun with Matlab??

Derivs, there´s no “compression” of the scales. They are log scales. Makes it easy to compare the distance from the trend line in each country, a measure of monetray tightening.

That was my impression until I saw the “France NGDP” one on the top right. Does not look like a log scale to me. I will take your word for it though.

Dervis, I checked. It is a log scale for France

I expect you have done it before, though not recently I think, but what are the equivalent charts for each of the US regional Fed’s NGDP pathways? Does the hawkish’ness of doveish’ness of the Governor reflect their own geography?

Marcus,

Thank you, I very much appreciate that you actually took the time to confirm that one.

Regards.

James–excellent question—but dogma trumps all is my guess.

The Euro, as Milton Friedman predicted, is unworkable. A union of Germany with Greece? Egads.

California with Alabama with Illinois with Vermont?

Ah1 But a political and fiscal union. Makes all the difference (in addition to common language – maybe not so “common” nowadays – and all sorts of othe “sharing” arrangements)

“390-400 wide and then 400-490 is smaller????” <—-my first comment.

My apologies, but this was making me nuts today. Enough to come back and give it a 2nd look. Please tell me that I can not make out the font and that I am mis-reading the Y axis. I keep reading it as I did in my first comment. 390-400-490-500, I have to believe it should be 350-400-450-500. It just looks like the 5's are 9's, but can not be. If you say that you properly read my first comment and those are 9's and not 5's I definitely need to go back to math class.

I assume you are in the States, but as an FYI, I was walking through Ipanema/Leblon today and I have to say I have never seen so many sales and so many empty stores.