Matt O´Brien has a charming piece:

There’s supposed to be a trade-off between inflation and unemployment, but there’s no sign of one right now.

Well, it hasn’t for a while actually. The Federal Reserve, you see, faced the same situation in the 1990s. Back then, unemployment had already fallen about as far as they thought it could, but prices stayed dormant. The question was whether they should keep trying to push unemployment down, or raise rates to preempt even the possibility of inflation. It was, in other words, a question about the “natural rate of unemployment.” That’s an idea that goes back to Milton Friedman, and it says, simply enough, that inflation will accelerate if unemployment falls below a certain level. Economists assume that level, the so-called “natural rate,” is somewhere around 5.5 percent, but that’s only a guesstimate. It might be higher or lower depending on big-picture economic changes.

And there were a couple of those in the 1990s. Information technology, as then-Fed Chair Alan Greenspan argued, had made workers more productive, and that made inflation less of a threat. Workers also had less leverage than they used to, even when unemployment was low, due to deunionization. And the Fed’s own success at whipping inflation had given it enough credibility that people were starting to expect less of it, too.

But the hawks, including a Fed governor named Janet Yellen, were still worried that they’d let unemployment drift too far below its natural rate—and that there’d be an inflationary price to pay. “Clearly we have an economy operating at a level where we need to be nervous about rising inflation,” Yellen said in May 1996, and “we need to be vigilant in scrutinizing the data for signs of rising wages and salaries.”

Aren´t we lucky that wage increases are flat?

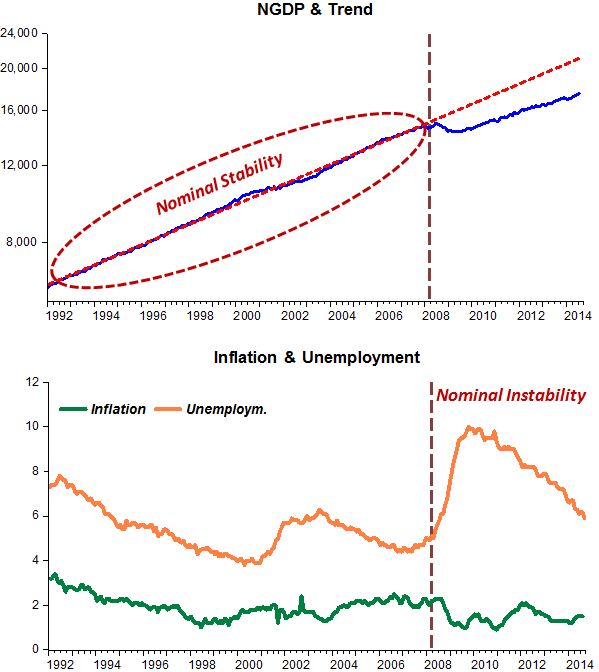

But the real lesson of the 90s had nothing to do with (an imaginary) Phillips Curve. It was about the Fed´s successful maintenance of Nominal Stability!

Egads, and they call Yellen a dove. She has said a one percent inflation is appealing. Maybe that is dovish—-after all, Plosser gets a seraphic look on his face when he talks about deflation.

Central banking cannot be left to central bankers.