Recently I´ve been having a “debate” with Atif Mian and Amir Sufi (A&A)(here, here). Now they write “Monetary Policy and Secular Stagnation”:

The Federal Reserve directly controls the short-term interest rate. But what it really tries to target is inflation and its expectations. The Fed’s goal is to achieve the target of 2% inflation in the long-term, and its preferred price index is the core personal consumption expenditure price index that excludes the volatile food and energy sectors (or core PCE for short). So how has the Fed performed in achieving its target of 2% inflation in the past 15 years?

And show a version of this chart:

The chart above plots the implied core PCE index if inflation had met its 2% target (red line), and the actual core PCE index (blue line) starting from 1999. The blue line is consistently below the red line, the gap has only diverged further since the Great Recession. The cumulative effect is that today the price level is 4.7% below what it should have been had the Fed achieved its long-run target.

They´re quite right to say that what the Fed “really tries to target is inflation and its expectations”. But until very recently (January 2012) that was just an “implicit” target. In fact, Greenspan was staunchly against making any target explicit. That was Bernanke´s pet project. What the Fed said it wanted was “low and stable” inflation.

The other thing wrong with A&A´s argument is that they are discussing a “Price Level Target (PLT) and surely that was not what the Fed was targeting, even implicitly. A PLT differs from an Inflation Target (IT) in that while in the former bygones are not bygones, in the latter they are.

A&A continue misleading their readers:

The divergence between target and actual inflation is all the more striking given the elevated rate of unemployment during the sample period. We have discussed in a previous post how the post-2001 and post-2009 recoveries were “jobless” – a recovery in output but not much in employment. The Fed has a dual mandate – inflation targeting and maximizing employment. It is traditionally believed that there is a trade-off between the two and a higher level of unemployment permits the Fed to go beyond its 2% inflation target (this is the famous Taylor rule). Yet the Fed has failed to achieve its target inflation despite high unemployment rates.

To say the level of unemployment was “elevated” during the sample period is very misleading. For the 1999-07 period the average rate of unemployment was a very low by historical standards 4.9%, only going up strongly when the crisis hit. And PCE-Core inflation averaged 1.9% in 1999-07, therefore very close to the 2% implicit target rate! [Note: In my posts “debating” A&A linked to above, I have shown what really caused the jobless recovery after the 2001 recession as well as the job loss recovery in the present cycle]

They go on:

It is hard to fault the Fed for not trying – it brought short term rates to zero for an extended period of time, and bought trillions of dollars in bonds. Yet the gap between the red and blue lines continued to diverge.

The Fed’s difficulty in maintaining a 2% target is not just about the Great Recession. The divergence started in the 2000′s despite the Fed keeping nominal rates quite low by historical standards. In fact the only period when the blue line runs parallel to the red (implying a 2% rate of inflation for a while) is the 2004-2006 period when the economy witnessed an unprecedented growth in credit.

Their blog (and forthcoming book) is called “House of Debt”, so debt has to figure prominently in their argument. But as the chart shows, the debt/GDP ratio begin to rise strongly in 2000 (not 2004) and continued going up until 2007. Note that all the debt increase is explained by mortgage debt. For that one should look to the distorted incentives mostly provided by the government´s homeownership policy.

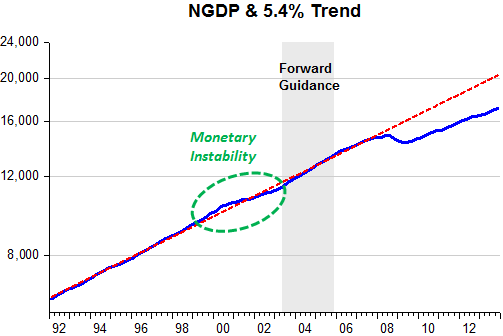

But it´s interesting that they note that prices picked up in 2004-06. That was not because of an “unprecedented growth in debt” but because with the Fed adopting forward guidance in August 2003, monetary policy became more expansionary and allowed nominal spending (NGDP) to climb back to trend after the nominal instability that marked the 1998-03 period. The chart illustrates:

A&A conclude:

What we are witnessing is the limit of what monetary policy alone can do. Sometimes there is a tendency to assume that the Fed can “target” any inflation rate it wishes, or that it can target the overall price level – the so-called nominal GDP targeting. The evidence suggests that the Fed may not be so omnipotent.

We are witnessing no such limit. What we are witnessing are the unsatisfactory effects of an Ad Hoc and timid stance of monetary policy (indicated by the lack of convergence of nominal spending towards trend). A&A also make the mistake of saying that PLT is the same as NGDPLT. As the first and last chart show, they´re not!

Excellent blogging…and the Fed will not even hit its own inflation targets which are dubiously low (even if I did like inflation targeting, which I don’t).

Excellent chart too on mortgage debt…that was the bomb.

I think we need a more mayeutic (socratic) view.I see a tendency here too repeat over and over the same arguments (and charts!). Well, I insist the trade-off between inflation and unemployment is not a stable one, especially in unusual, extraordinary times, is it? By the way, for those who think I utterly disagree with what I read here, what I have just written would be a strong argument in favor of a NGDPT. Now, what is really there for the Fed to target ? Unemployment? Jobs? Output? These are real variables! Can a nominal variable really determine the real side of the economy? Maybe in the short run. For me 5 years is not the short-run! If you add unstable relations, then you do not really know what you are targeting.You can’t separate both real and nominal magnitudes. If one wants to target a nominal magnitud such as NGDP, one is implicitly (i) assuming stable relationship between real GDP and inflation and (ii) stating that one cares about pice inflation! Then why so much anger against price stability? Moreover, since this is a jobless recovery, shall we define a nominal Jobs target? A kind of payroll target? Or may be a nominal consumption target? No one appears to have a persuasive and convincing explanation of what is really going on. Again, sailing in unchartered waters. Please do not get me wrong. This blog is getting kind of boring. We shall improve over our previous arguments and really get to the bottom of the underlying issues. Otherwise we keep going back and forward with the same arguments. An endless and unproductive debate. This shall not turn into a debates on ideas or dogmatic discussion. Repetion does not add any value, especially if there are so many germaine questions that remain unanswered. I hope I have posed some of them. If you have an answer to some of them, you replies are welcome.

Have a good one!

I like Theyenguy reply in the orginal blog. He is right. Financial stability is a major consideration in this debate. The 2008 crisis was a financial crises, not a macroeconomic type of crisis of unsustainable fiscal policies, inadequate monetary policy, an external imbalance or an exchange-rate crisis. This was a run on banks and other financial intermediaries and market products. There was a bubble sustained by bullish expectations. Many saw it coming, but the idea that the bubble did not exist because the US economy was becoming more productive and internationally competitive was accepted without much thought. Financial crises are rare animals, with many non-linearities and unstable relationships. I welcome someone who moves out of the traditional way of thinking and come up with other ideas to try to get to the real bottom of thinks. Just look at the amount of lending and overindebtedness prior to the crisis, the increasing real estate prices, the increasing in the current account account deficit. There were many bankruptcies across many real and financial sectors when the bubble burst. I think this might be a reason for a jobless recovery. What about the debt-deflation theory based on the transfer of well from debtors to creditors? What about the excessive risk-taking of many financial intermediaries? What about the real sector corporations that went out if business? what about the guys who lost there Jobs? what about the changes brought by the information era? What about the effects of “el niño” in the form of natural disasters? What about the penetration of Chinesse products into the US economy? Consumers and workers were hard hit by the financial crisis? Many not only lost their Jobs, but their homes, the capacity to spend on education? What about the lost of wealth in trillons of US dollars? To try to come up with an answers in terms of prices inflation and the output gat, or nominal GDP for that purpose is too simplistic (and naive) a view. It appears some have not fully reaized the nature and extent of the crisis. Look at other advanced economies (Geermany, Japan and the UK). They are going through the same developments. The puzzling facts in the US crisis also apply to those countries. I hope, again, I am helping to enlighten the underlynig forces of a jobless recovery. Policy recommendations must be based in an accurate diagnostic of the actual state of the economy and the financial system. By the way, I do not think US consumers and frims are happy with the implications of high international commodity prices on their pockets and costs of inputs. I wish more considerations between the interactions between mnetary policy and financial frictions were brought into the discussion. The collapse of the Japan bubble in 1986 led the Japanese economy to a situation very similar to the one we are now observing in the US and other advanced economies. And Japan has not been able to fully come out of deflationary pressures and get jobs and the economy going even to the present day. Thanks Mr. Theyenguy for enlightening us.

AV, your two comments are long and “travel all over the place”. So I´ll also give you a “long answer” in the form of a selection of recent and ancient posts that address at least some of your concerns:

https://thefaintofheart.wordpress.com/2012/04/08/a-view-of-the-phillips-curve-leads-to-the-adoption-of-a-nominal-spending-target/

https://thefaintofheart.wordpress.com/2012/09/14/are-we-back-to-the-time-when-unemployment-and-inflation-were-conflicting-objectives/

https://thefaintofheart.wordpress.com/2012/08/25/the-origins-of-the-great-inflation/

https://thefaintofheart.wordpress.com/2011/11/03/niskanen-a-companion-piece-to-%E2%80%9Ca-test-of-the-demand-rule%E2%80%9D/

https://thefaintofheart.wordpress.com/2011/11/03/william-niskanen-a-proponent-of-ngdp-targeting/

https://thefaintofheart.wordpress.com/2011/11/25/creditism-and-the-great-recession/

https://thefaintofheart.wordpress.com/2012/03/02/on-bernanke-paying-lip-service-to-nominal-stability/

https://thefaintofheart.wordpress.com/2014/02/27/this-is-straight-from-a-script-to-a-bela-lugosi-film/

https://thefaintofheart.wordpress.com/2014/03/01/identifying-the-stance-of-monetary-policy/

https://thefaintofheart.wordpress.com/2014/01/27/will-bernankes-legacy-be-having-introduced-a-unit-root-in-us-rgdp/

https://thefaintofheart.wordpress.com/2013/05/12/the-great-recession-ngdp-fueled-or-balance-sheet-fueled/

https://thefaintofheart.wordpress.com/2014/03/14/lessons-from-australia/

Dear Mr Nunes

Thanks for bringing this up to my attention.

Kind regards.

AV

Pingback: TheMoneyIllusion » Mian and Sufi on monetary policy